UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

Indonesia misses coal mine methane emissions mitigation in decarbonisation plans

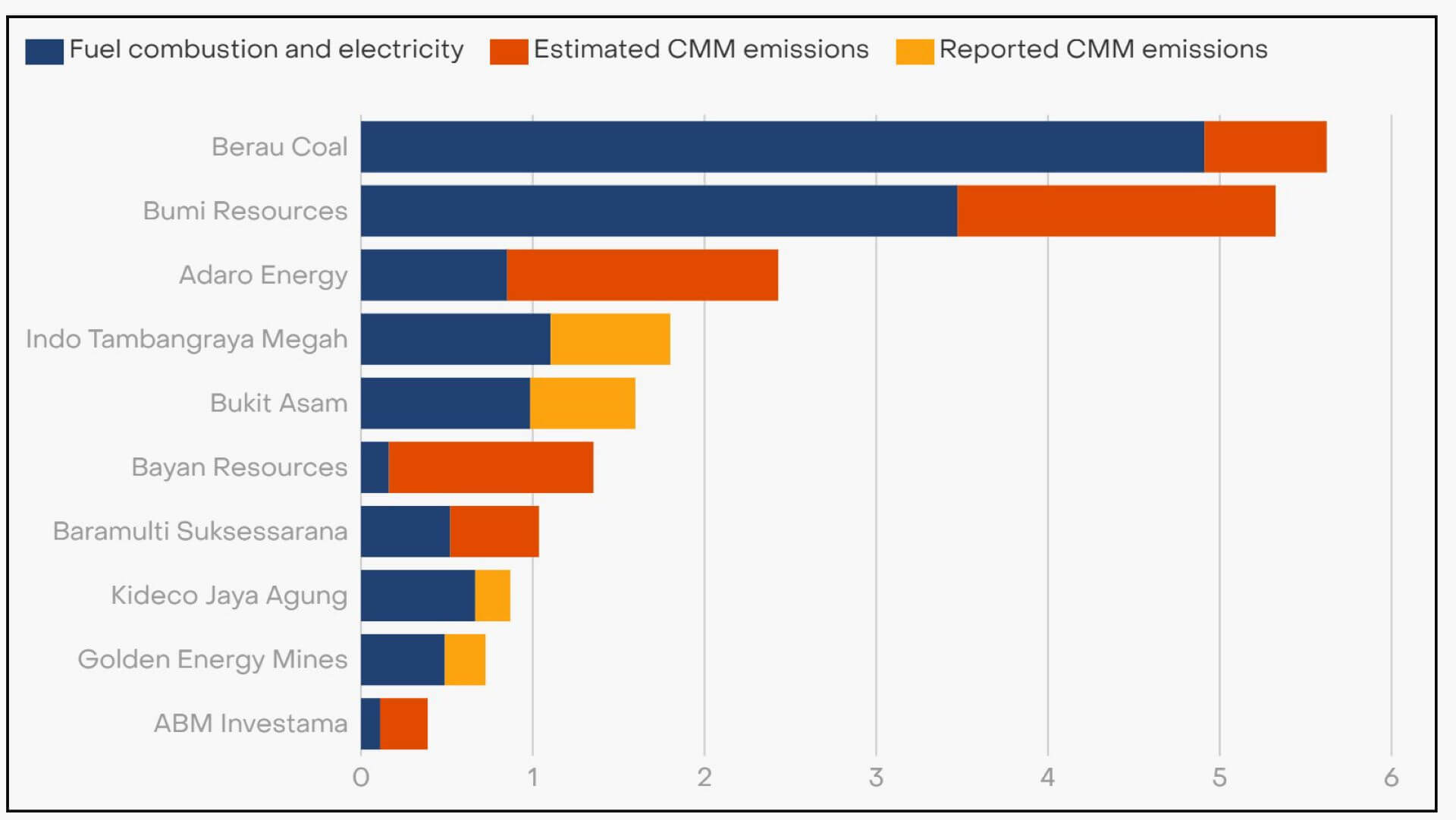

Indonesian coal mining companies are significantly overlooking coal mine methane (CMM) emissions and not including their mitigation in decarbonisation plans, according to a new report from think tank Ember. Meanwhile, the International Energy Agency (IEA) forecasts that global coal demand is set to remain broadly flat through 2025.The Ember report analyses the emission profiles of 10 major coal mining companies in Indonesia (see Fig 1), responsible for half of the country’s coal production. It also assesses their emissions reduction actions and decarbonisation pathways.

The coal companies studied have shown ‘varying commitment’ to developing emissions inventories and reducing CO2. However, most actions have yet to lead to substantial emissions cuts, and many companies do not measure or report CMM emissions, leaving methane mitigation out of their decarbonisation plans, notes Ember.

The report reveals that only four of Indonesia’s 10 largest coal mining companies include CMM in their emissions inventories. These include Indo Tambangraya Megah, Bukit Asam, Golden Energy Mines and Indika Energy. For the rest, ‘unreported CMM emissions could be as significant as the emissions from on-site fossil fuel combustion and purchased electricity combined’, claims the study.

Fig 1: Indonesian coal company emissions in 2023, in mn tCO2 – six out of the 10 biggest coal companies did not report coal mine methane (CMM)

Note: CMM emissions are estimated using the IPCC method for fugitive emissions from surface coal mining with an average emission factor of 1.2 m3 of methane/t and methane’s global warming potential of 29.8.

Source: Companies’ sustainability reports and Ember analysis

This oversight means that the full environmental impact of coal mining is not being accounted for, leaving a critical aspect of decarbonisation efforts unexplored, says Ember. In total, the estimated CMM emissions of these 10 coal companies could exceed 8mn tCO2e, more than a third of the companies’ potential total emissions, suggests the study.

The report also analyses the Indonesian government’s recent approval of a coal production quota of 922mn tonnes for 2024. This is a significant increase from the current target of 710mn tonnes, ‘adding another layer of complexity in understanding the overall sustainability of the coal industry’, comments Ember.

This decision comes at a time when primary domestic coal demand is in decline and variable demand projections impact major importers.

‘For Indonesian coal companies, understanding and addressing their methane emissions is crucial, not just for companies’ decarbonisation efforts and ensuring compliance with national and international standards, but also for improving safety and implementing the most commercially competitive decarbonisation strategy,’ concludes Ember.

According to the Energy Institute’s Statistical Review of World Energy 2024, Indonesia was the fifth largest consumer of coal (4.3 EJ) after China (91.94 EJ), India (21.98 EJ), the US (8.2 EJ) and Japan (4.54 EJ). China accounted for just over half, 56%, of global consumption.

Global coal demand set to remain broadly flat through 2025, according to IEA

Meanwhile, the International Energy Agency (IEA) reports that despite the rapid expansion of renewables, the huge growth of electricity demand in key economies suggests the world’s consumption of coal will stay largely stable this year and next.

According to the Agency’s latest update on global coal market trends, the world’s use of coal rose by 2.6% in 2023 to reach an all-time high, driven by strong growth in China and India, the two largest coal consumers globally. While coal demand grew in both the electricity and industrial sectors, the main driver was the use of coal to fill the gap created by low hydropower output and rapidly rising electricity demand.

In China, which accounts for more than half of global coal consumption, electricity generation from hydropower has been recovering in 2024 from last year’s exceptionally low levels. This, alongside the continued rapid deployment of solar and wind, is significantly slowing down the growth in coal use in 2024. But another major annual increase in China’s electricity demand, forecast at 6.5% in 2024, makes a decline in the country’s coal consumption unlikely, says the IEA.

In India, coal demand growth is set to decelerate in the second half of 2024 as weather conditions return to seasonal averages. In the first half of the year, India’s coal consumption rose sharply as a result of low hydropower output and a massive increase in electricity demand due to extreme heatwaves and strong economic growth.

Coal demand in Europe is continuing on the downward trend that began in the late 2000s, largely due to emissions reduction efforts in power generation. After having fallen by more than 25% in 2023, coal power generation in the European Union is forecast to drop by almost as much again this year.

Coal use has also been contracting significantly in the US in recent years, but stronger electricity demand and less switching from coal to natural gas threaten to slow this trend in 2024. Japan and Korea continue to reduce their reliance on coal, although at a slower pace than Europe, reports the IEA.

On the supply side, global coal production is forecast to decrease slightly in 2024 after steady growth the year before. In 2024, coal production in China is moderating after two years of staggering growth, says the report. In India, the push to boost coal production continues, with a supply increase of around 10% expected in 2024. In advanced economies, coal production is in decline, broadly reflecting demand.

The report also finds that trade volumes are at the highest levels ever seen despite the collapse of imports in Europe and the decline in imports in north-east Asia (Japan, Korea and Chinese Taipei) since 2017. However, other countries are stepping in to take up available supply. In 2024, Vietnam is set to become the fifth largest coal importer, surpassing Chinese Taipei. Imports to China and India remain at all-time highs.

Despite declining domestic production in China in the first half of this year, tighter sanctions on Russian producers and disruptions in a few exporting countries, the global coal market is well supplied, according to the report. With more stable natural gas prices than in recent years, coal prices remained range-bound in the first half of 2024. They have returned to levels last seen before the global energy crisis but remain elevated due to inflationary pressures, it concludes.

News details

Countries: Indonesia - Global -

Subjects: Energy consumption, Coal markets, Methane, Greenhouse gases, Forecasting, Coal