UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Big Oil bets on biofuels as part of energy transition

27/11/2024

News

The world’s leading oil and gas companies are ramping up investments in biofuels as they navigate the energy transition, with more than 40 projects planned by the end of the decade, according to Rystad Energy’s latest analysis.

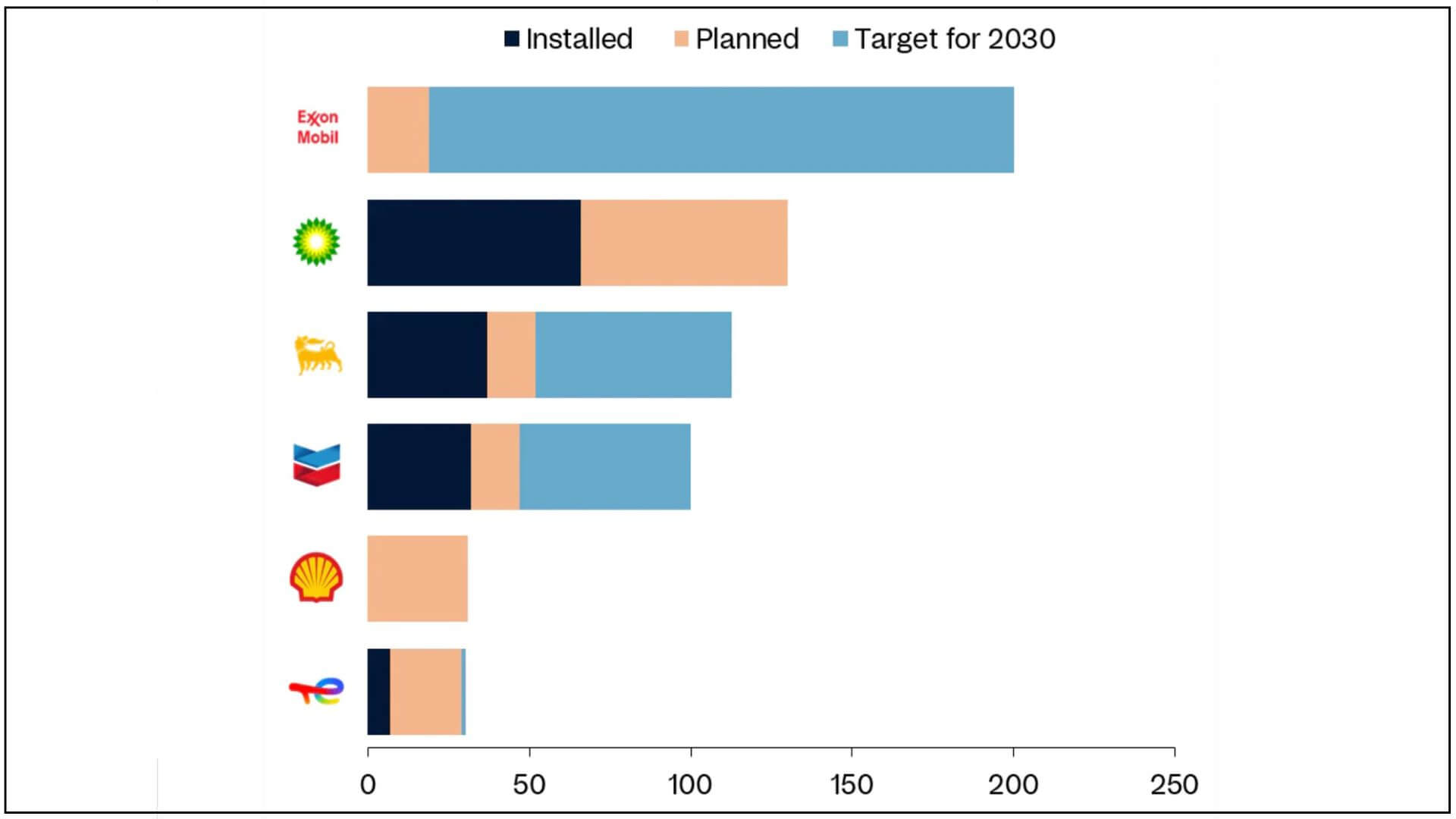

Major players such as BP, Chevron, Shell, TotalEnergies, ExxonMobil and Eni, finding themselves under increasing regulatory and market pressures to reduce carbon emissions and transition away from traditional fossil fuels, are increasing their attention on the biofuels sector, Rystad reports. They have collectively announced 43 projects that are either already operational or are set to come online by 2030.

While investments span various biofuels products, including biodiesel and ethanol, a clear focus is on hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF), which are expected to account for nearly 90% of the projected biofuels production in Rystad’s analysis. These biofuels are being lauded for their potential as low-carbon ‘drop-in’ fuels that can be seamlessly integrated into existing heavy transport, marine and aviation fuel systems.

The implementation of these investments could add a combined 286,000 b/d of production capacity, according to Rystad. Analysing the specifics, 31 of these projects are greenfield developments, six involve co-processing (integrating bio feedstock into existing crude-oil refineries to produce a blended feedstock), while another six are full conversions of refineries to facilities dedicated exclusively to biofuels production. Co-processing stands out as a cost-effective option, allowing companies to leverage existing infrastructure and reduce upfront investment, making it an appealing choice for oil majors entering the biofuels market, notes Rystad.

The 43 biofuels projects announced by the oil majors ‘signal promising developments in the industry’, says the market analyst. For example, Chevron’s Geismar (Louisiana, US) project, the largest of the 31 greenfield initiatives, is set to produce 22,000 b/d of biofuels, ‘marking a significant addition to global capacity’. Additionally, Chevron’s El Segundo (California, US) refinery, the largest in co-processing capacity, converted a diesel hydrotreating unit last year into a 10,000 b/d renewable facility. BP’s Kwinana (Western Australia) project, the largest announced refinery conversion, is also poised to significantly increase the production of sustainable fuels. By 2030, this project is expected to produce 50,000 b/d of HVO and SAF, whose output could be pivotal for meeting rising demand for biofuels in the near future, according to Rystad.

Among the leading companies, BP stands out by having the largest announced production capacity in its pipeline, reaching a combined 130,000 b/d of ethanol and HVO/SAF capacity. This positions it as a global frontrunner in the bioenergy space, says Rystad.

BP and Chevron hold significant positions in operational capacity. BP’s acquisition of Bunge Bioenergia, a leading Brazilian biofuel producer, has substantially increased its production capacity to approximately 66,000 b/d. The acquisition has enabled BP to exceed its 2025 milestone of 50,000 b/d and positions the company to achieve its biofuels target of 100,000 b/d by 2030. Additionally, Chevron’s purchase of Renewable Energy Group and Eni’s operational advanced biofuels capacity of 22,000 b/d, driven by both co-processing and conversion projects, further solidify their positions in the expanding biofuels market.

Fig 1: Biofuels production portfolio capacity* versus 2030 target (in ,000 b/d)

*includes both operated and equity share projects

Source: Rystad Energy

TotalEnergies has also outlined aggressive biofuels targets, aiming to use waste biomass for 75% of its biofuels production by the end of 2024. To achieve this, the French integrated energy and petroleum company plans to prioritise waste and residues from the food industry, such as used oils and animal fats, to avoid land-use conflicts. Meanwhile, ExxonMobil is gearing up to start biofuels production at its Strathcona (Alberta, Canada) refinery next year, with an initial capacity of 20,000 b/d. The company also plans to launch 12 additional biofuels projects to help it reach its goal of 200,000 b/d by 2030.

‘As oil majors shift to lower-carbon energy, there is a clear trend toward advanced biofuels, particularly HVO and SAF, with companies scaling up production to meet rising demand from the aviation and heavy transport sectors,’ says Rystad. ‘Despite some project delays, biofuels are seeing a significant increase in investment and innovation as 2030 decarbonisation targets loom and the market for fossil-fuel alternatives grows,’ it concludes.

Connecting the dots: Neste’s Entry into Canada

In a related development, Neste and Air Canada have signed an agreement for the supply of 60,000 tonnes (77.6mn litres) of Neste MY SAF, marking the first time Neste’s SAF will be supplied to Canada. The agreement not only represents Air Canada’s first commercial import of SAF into the country but also contributes significantly to the airline’s target to procure SAF to account for 1% of its estimated 2025 jet fuel use.