UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Unlocking pumped storage hydro for net zero Britain

31/7/2024

8 min read

Feature

The global energy network requires a very large build-out of long-duration energy storage (LDES) to reach net zero emissions. While pumped storage hydro (PSH) is a mature and reliable technology that can meet a large portion of this need, the business model it would be applied to is new. In the UK, the government is exploring a cap and floor scheme to unlock investment into PSH development. Its implementation could distort the market. Alterations of that scheme, which could overcome those problems, are proposed by Roderick MacLeod, Director, Glen Earrach Energy (GEE).

Achieving a net zero energy future requires a significant increase in long-duration electricity storage (LDES), in particular ‘LDES Long’, which provides storage durations between 16 and 32 hours. Estimates suggest that 20 GW of LDES Long capacity is needed, a 25-fold increase on the UK’s existing base.

Pumped storage hydro (PSH) – a proven, mature and reliable technology – offers a solution, and could fulfil nearly half of the nation’s LDES Long needs.

The Glen Earrach pumped hydro scheme in Scotland proposes to move water between two lochs, Loch Breac Dearga and Loch Ness, acting like a giant water battery storing excess wind power when it is plentiful and releasing it when the wind dies down. With a substantial height difference exceeding 480 metres between the upper and lower lochs, the facility will be capable of delivering up to 30 GWh of clean energy and up to 2,000 MW installed electrical generation capacity (subject to further investigation and feasibility works). Its output could surpass that of over 1,000 onshore wind turbines and deliver clean energy for over a million decarbonised homes.

However, PSH deployment remains stagnant, with only 740 MW capacity deployed almost 50 years ago.

Barriers to PSH investment

High upfront costs, long build times, construction risks and revenue uncertainty are the primary hurdles to new PSH deployment. Government support has been crucial globally for derisking PSH projects and unlocking necessary capital. The Scottish government has urged the UK government to provide a suitable market mechanism for hydropower.

A 2021 study by Robert Hull for Scottish Renewables concluded that an income floor for long-duration flexibility would effectively achieve the government’s net zero goals. Hull emphasised that support mechanisms must align with the asset’s business model, suggesting that while an income floor is essential for financing, a standardised cap (maximum income limit) would introduce market distortions. Implementing an income floor regime is simpler and more beneficial.

In January 2024, the UK government initiated a consultation to explore a cap and floor scheme for PSH investment, guaranteeing a minimum income (floor) and recouping losses through a cap. The UK general election paused the consultation, but the scheme’s design is crucial for incentivising PSH development. As a climate leader, it is vital for the UK to implement an effective cap and floor scheme for both domestic and global net zero ambitions.

Large hydropower projects are susceptible to significant cost overruns, with expenses often exceeding initial estimates by 20% or more.

Investors such as banks, and the government, want to avoid funding unforeseen expenses. The cap and floor contract must clearly define how cost overruns will be handled, with thorough upfront studies and comprehensive geological investigations to mitigate this risk. A cap and floor scheme could adjust the income floor for unforeseen circumstances during construction if effectively managed by developers and contractors. Prioritising projects with favourable risk-return profiles is essential.

Banks prefer investing in financially viable PSH projects with high capex and round-trip efficiency, as these offer lower overall costs per unit of power and storage, minimising reliance on income floor support. Key factors influencing a PSH project’s capex efficiency include site selection (topography), head height and technology selection. Favourable topography with minimal excavation and nearby existing infrastructure can significantly reduce construction costs.

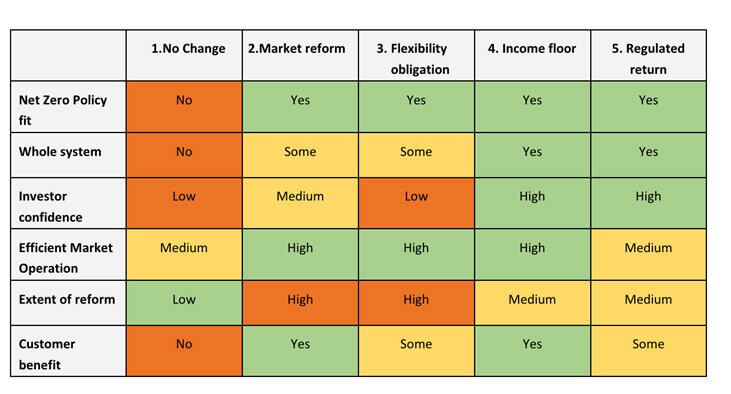

Table 1: A comparison of different market models suggests that an income floor for long-duration flexibility would be the most effective way of achieving the government’s net zero policy aims

Source: Filling the flexibility gap: Realising the benefits of long duration electricity storage, A report for Scottish Renewables, March 2021

Attracting investment from banks

Attracting investment requires addressing bank concerns beyond just project efficiency. Banks must protect themselves against the potential loss of their principal and this is where a guaranteed income floor can help.

The interconnector model for the cap and floor scheme introduces a maximum income limit (cap) alongside the minimum income guarantee (floor). However, reaching the cap could disincentivise efficient market operation. This is a risk to the consumer on two counts: 1) the PSH would no longer be fulfilling its mission of compressing peak electricity prices; and 2) in trading terms, the cap places the regulator as benefitting from high levels of volatility, potentially disincentivising them from pursuing policies that stabilise prices.

PSH facilities traditionally operate in the merchant market, where electricity traders exploit price differences across time to maximise revenue. This market activity optimises PSH use, leading to reduced price volatility. However, a cap could discourage the operation of PSH facilities in the merchant market and the financing options available to developers.

The incentive system, therefore, needs to be designed to minimise risks for all (ie the banks, government and consumers) and incentivise using LDES strategically for maximum benefit to the power grid, avoiding such distortions.

In January 2024, the UK government initiated a consultation to explore a cap and floor scheme for pumped storage hydro (PSH) investment, guaranteeing a minimum income (floor) and recouping losses through a cap… The scheme’s design is crucial for incentivising PSH development.

Proposal for a floating cap and soft floor

One way around the banks’ requirements and reducing the risk of government payouts is to introduce a floating cap and soft floor. How would this work?

The floor is activated if a pre-defined PSH index shows a shortfall in income (because market conditions have been bad), the operator claims the shortfall, or the bank believes there is one. The responsible government department (Department of Energy Security and Net Zero; DESNZ) or energy regulator (Ofgem) then investigate to see if the problem that led to the floor breach is unavoidable (ie justified) or the project’s fault (unjustified).

If it is justified, the floor mechanism will make a loan to the PSH, but only for the unavoidable part of the shortfall. The PSH will have to pay interest on this at the same level the government itself pays for short-term loans. However, if the project’s shortfall is unjustified, the floor loan comes with a higher penalty and interest rate. If the floor mechanism is used, a temporary cap on all profits is triggered until the government loan is repaid with interest.

Even under the most challenging scenario – a combination of worst-case capex over-runs and unfavourable trading conditions over 25 years – GEE’s project would only require floor support for a limited number of years. Furthermore, any payouts triggered by the floor would be repaid within a year or two in most cases.

But how does the consumer benefit? Income tax on PSH operations is progressive, meaning it redistributes wealth towards lower-income earners, who are also electricity consumers. This contrasts with traditional cap payments, which can disproportionately benefit the largest consumers of electricity.

PSH projects receiving support through the cap and floor mechanism would be taxed based on a PSH Index. This reflects the estimated earnings the PSH facility should achieve were it operating optimally in the market. This approach ensures fair taxation by capturing the full potential profits of the PSH asset which has been financed with a lower cost of capital through the government’s cap and floor mechanism.

By channelling the upside provided by market volatility to the government through taxation, the regulator can remain neutral and focused on its core mission – reducing prices and volatility for all consumers.

GEE’s financial model shows that over the 120-year life of the PSH, it would pay out between £10–12bn in income tax (in 2023 pounds sterling) to the Exchequer; this is in addition to community benefit payments estimated to be in excess of £2bn over the same period and £2bn NPV (net present value) in costs savings to the grid (calculated over the first 20 years of operation only).

Bear in mind that 120 years is only the beginning, and that with adequate maintenance, a PSH asset can continue running as long as you want. Assets such as these are strategic to the country.

The cap and floor system described above is designed to de-risk the investment for everyone involved. It also motivates project owners to run the asset efficiently and avoid needing government help. It encourages fast loan repayments by project owners should they have to rely on the floor, and guarantees the government gets a fair share of any profits through taxes.

With the right financial frameworks in place, such as a well-designed cap and floor mechanism, we can mitigate risks, attract crucial investment and make substantial strides towards UK net zero ambitions. Importantly, this will allow the government to control which assets are brought forward in an orderly fashion, favouring the most strategic assets first.

Without a robust cap and floor regime, private financing through complex power purchase agreements (PPAs) might emerge. However, this is an untested and potentially risky approach for PSH projects that could lead to several more years of delay.

The government in its unique capacity can shape this new LDES market, steering it away from vested interests and ensuring it benefits consumers through lower electricity costs, taxpayers through tax revenue from PSH operations, communities through local benefit funds, and the environment by significantly reducing carbon emissions and by reducing the amount of renewables power (wind and solar) required to reach net zero.

- Further reading: ‘Water, water everywhere – facilitating the expansion of hydropower in the UK’. While hydropower is a well-established technology in the UK, current thinking is largely about developing smaller-scale schemes to supply local loads, and to add more pumped storage capacity to the grid. Kate Gilmartin AMEI, CEO of the British Hydropower Association (BHA) – which also advocates for tidal range energy – explores the options.

- The Scottish government has given development consent for a new 600 MW underground pumped storage hydro plant in Argyll, Scotland. It will be the first to be constructed in the UK since 1984.