UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Looming end of Russian gas transit through Ukraine to West sets the stage for LNG and pipeline diversions

24/7/2024

News

The European Union (EU) aims to ban Russian fuel imports by 2027. However, nearly half of Russia’s pipeline gas supplies to Europe and Moldova are still passing through Ukraine, totalling 13.7bn m3 in 2023, according to Rystad Energy. But the current five-year gas transit agreement between Russia and Ukraine is set to expire by the end of 2024, leading to concerns about the future flow of these gas volumes, warns the market analyst as the EU discusses the possibility of involving Azerbaijan in a future transit deal.

Rystad Energy suggests that Russia’s gas will need to be rerouted to Europe through alternative paths, requiring an additional 7.2bn m3/y of LNG to replace the gas transiting Ukraine. The disruption could happen sooner than anticipated, raising concerns among European nations heavily reliant on these gas supplies.

Countries such as Slovakia, Austria and Moldova are particularly vulnerable, importing about 3.2bn m3, 5.7bn m3 and 2bn m3, respectively, in 2023. Last year, Russian gas passing through Ukraine supplied EU countries via entry points in Slovakia and Moldova.

Italy’s energy company Eni and Hungary also imported Russian gas through Ukraine, while Slovenia and Croatia have been smaller takers of Russian gas via Ukraine.

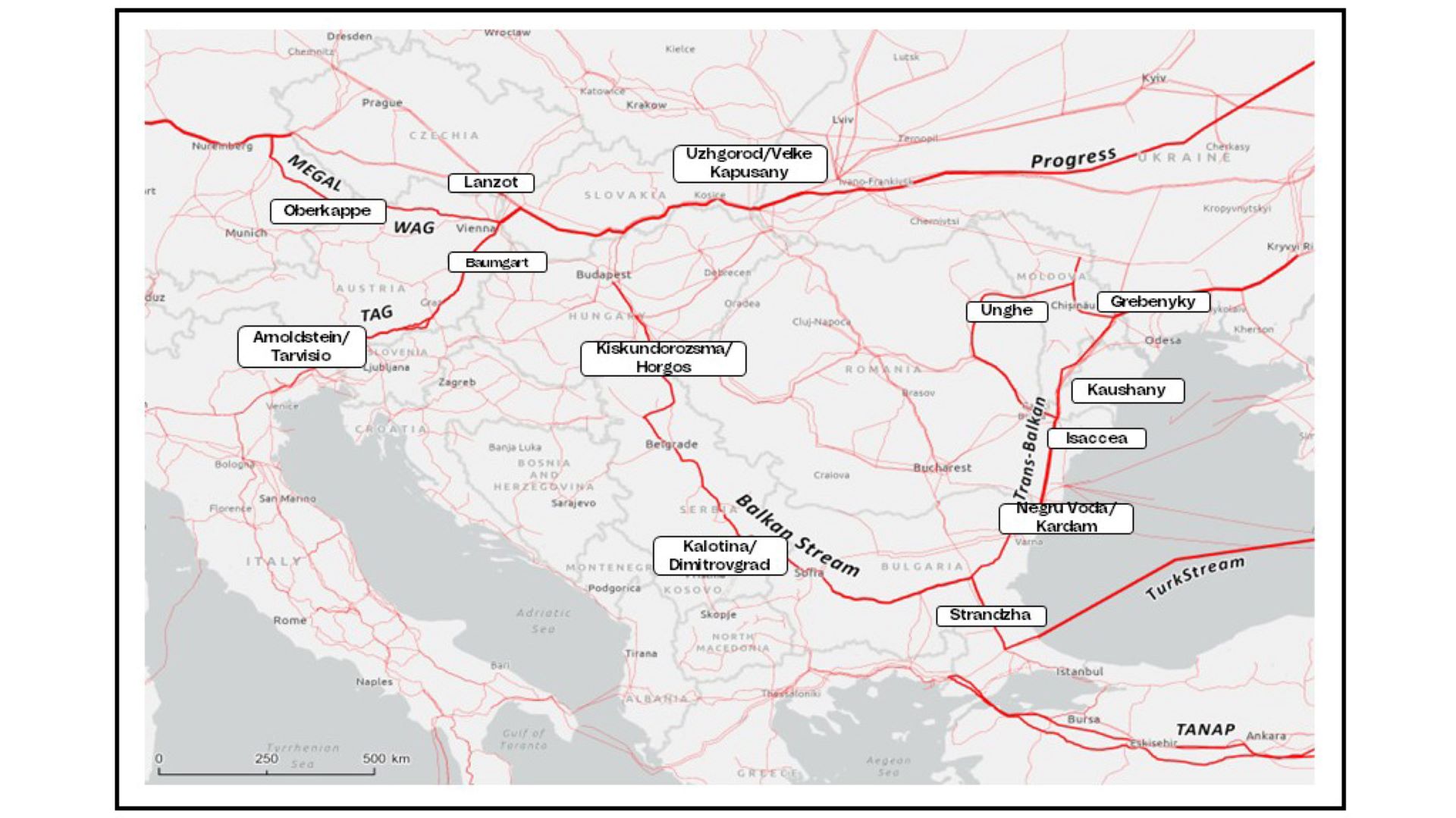

Halting Russian gas pipeline flows via Ukraine would significantly impact countries relying on these volumes, says Rystad Energy. For example, post-2025, Moldova would need to reroute its 2bn m3 supply via Ukraine, possibly through reverse flows of the Trans-Balkan pipeline using the Isaccea entry point between Romania and Ukraine (contingent on a transit agreement for the short 25-km distance through Ukraine). The Trans-Balkan pipeline, operating in reverse flow since 2022, enabled 0.54bn m³ of gas to enter Moldova via Ukraine from Romania in 2023.

Additionally, gas from the Southern Gas Corridor in Azerbaijan, as well as from Turkish and Greek LNG import terminals, can reach Moldova via the south. When the Russia-Ukraine transit agreement ceases, the only alternative supply routes for Central and East European countries would be the Balkan Stream and the Horgos entry point between Serbia and Hungary, suggests the market analyst.

Fig 1: Pipelines and entry points in Central and Eastern Europe

Source: Rystad Energy’s Gas & LNG Macro Solution (July 2024)

Rystad Energy forecasts potential changes to the 2023 gas balance for affected countries under the assumption of 50% and 0% flow of gas via Ukraine and capacity limitations at relevant entry point alternatives. Without Russian gas, Slovakia would find itself at the end of the flow chain, requiring about 4bn m3 of gas delivered through the Lanzhot entry point from the Czech Republic. With additional regasification capacity in Poland only available in 2025, a zero-flow scenario may even entail reverse flows from Austria into Slovakia.

Austria, the largest European importer of Russian gas in 2023, would increase imports from Germany via the Oberkappel entry point, expected to operate at its maximum annual capacity of 8bn m³. However, without short-term capacity adjustments, Austria’s import gap of 8.53bn m³/y cannot be bridged, potentially reducing gas transits to Hungary and stopping outflows to Italy. Austria might need to import up to 2.5bn m³/y from Italy via the Arnoldstein-Tarvisio crossing point if all Russian gas flows through Ukraine cease.

Italy, having largely achieved independence from Ukrainian transit, would still need to source about 3.75bn m³/y for Slovakia and Austria. These supplies could come from the Ravenna floating storage and regasification unit (FSRU) – providing 5bn m³/y from 2025 – and 1.23bn m³/y from pipelines through Tunisia.

Meanwhile, Hungary faces significant challenges if the Russian gas flow through Ukraine halts completely. Assuming Moldova is supplied from the south, the Trans-Balkan pipeline from Romania would be fully allocated, halting Romanian inflows. Austria would be unable to forward gas to Hungary, and Croatia won’t have additional regasification capacity before 2025, notes Rystad Energy. Hungary would then rely heavily on the TurkStream pipeline, requiring continuous maximum capacity operation at the Horgos entry point of 9bn m³/y. Alternatively, if Austria secures sufficient LNG from Italy, Hungary could receive additional gas through reverse flows at the Mosonmagyarovar entry point from Austria.

In preparation for these many eventualities, Central and Eastern European countries have collaborated to establish a ‘Vertical Gas Corridor’ under the EU’s Central and South Eastern Europe Energy Connectivity Initiative (CESEC). A memorandum of understanding was signed in Athens in January 2024, involving EU Energy Commissioner Kadri Simson and transmission system operators from Greece, Bulgaria, Romania, Hungary, Slovakia, Ukraine and Moldova. This corridor would leverage existing infrastructure in Ukraine and Moldova to enable LNG imports from Greece and Turkey to reach Slovakia, Hungary and, potentially, Poland.

Fig 2: Alternative supply: the Vertical Gas Corridor

Note: Capacity estimates according to Gas Transmission System Operator of Ukraine (GTSOU)

Source: Rystad Energy’s Gas & LNG Macro Solution (July 2024)

Furthermore, Turkey’s transmission system operator BOTAS and Bulgaria’s operator Bulgartransgaz agreed earlier this year to enhance gas entry capacity at the Strandzha 1 entry point. This will increase flows from Azerbaijan and the Caspian Sea region into Europe, potentially boosting Azerbaijan’s EU gas exports from 13bn to 20bn m³/y by 2027 and facilitating long-term transport of Iranian gas through the Solidarity Ring Initiative.