UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Feeding our energy-hungry world

3/7/2024

14 min read

Feature

Our appetite for energy continues to grow, and with it consumption of fossil fuels, according to the 73rd Statistical Review of World Energy, published by the Energy Institute, which records the production, consumption and trade flows of fossil fuels and renewables, around the world, by region or by country. The 2023 data, published in June, reveals an increase in global energy consumption, in fossil fuels and in carbon emissions, but also an increase in renewable sources of energy. Writes New Energy World Senior Editor Will Dalrymple.

The world used more energy than ever before in 2023, according to the latest Energy Institute Statistical Review of World Energy, co-authored by KPMG and Kearney. Record-high primary energy consumption rose to 620 EJ, 2% higher than the prior year’s previous high.

Our energy needs continued to be largely met by non-renewable fuels: total fossil fuel consumption increased by 1.5% to 505 EJ. But overall emissions from energy increased even more than that, by 2%, to exceed 40 Gt for the first time. This bucks the long-term trend of emissions growing at about half the rate of energy.

Indeed, the report contained both good and bad news about changes in the energy mix. On the one hand, it was slightly less fossil-based in 2023 (81.5% compared with 82% in the previous year). But on the other hand, the mix within fossil has become more carbon-intense – with more coal, more oil and gas broadly flat.

Coal and oil consumption both reached new highs in absolute terms. Coal consumption was up 1.6% on 2022 reaching a record high of 164 EJ, driven predominantly by China and India. Coal consumption in India exceeded that of Europe and North America combined for the first time.

Oil consumption exceeded 100mn b/d in 2023 for the first time ever, increasing over 2% compared to previous year. Notably, growth in production was met by non-OPEC+ producers, of which the US remained the largest, seeing its output grow by 9%. Global gasoline consumption of 25mn b/d was just above its 2019 pre-COVID level, but kerosene (largely used for aviation fuel) had yet to return to its 2019 peak, despite growing strongly (17.5% in 2023).

In contrast, global natural gas production and consumption remained flat in 2023. LNG supply grew by nearly 2% to 549bn m3. In supply terms, the US overtook Qatar as the world’s largest exporter of LNG, seeing its supply increase nearly 10% versus a 2% drop from Qatar. Meanwhile, the Russian Federation saw falls in both its LNG and pipeline exports, with LNG dropping nearly 2% (0.8bn m3) and pipeline supplies dropping 14% (18bn m3).

Methane emissions climb

In 2023, CO2e emissions from energy-related processing and methane emissions rose 5.5% to reach nearly 5 Gt. Together they represent around 12% of the total energy-related CO2e emissions recorded for 2023. Tackling fugitive methane emissions is one of the most impactful, if not the most impactful, action we can take across the next decade.

The Energy Institute is participating in these efforts through the Methane Guiding Principles partnership, founded in 2017.

Europe and the US

Speaking of Russia, 2023 was the first full calendar year of its conflict with Ukraine, so a fuller picture of European gas demand reduction and supply substitution has emerged.

Europe’s shift away from Russian supplies solidified in 2023, with LNG imports outflanking piped gas for the second year in a row. Russia’s share of EU gas imports fell from 45% in 2021 to 24% in 2022, then to just 15% in 2023. European pipeline imports fell by 26% (40bn m3), almost entirely attributable to supplies from Russia.

Europe’s need for gas was moderated by a warm winter and high gas prices. Overall, European gas demand fell by 7% in 2023 following a fall of 13% the previous year. Data published by the EU’s Copernicus Climate Change Service showed the average temperature in Europe from December 2022 to February 2023 was 1.4°C above the 1991–2020 average for the northern hemisphere – Europe’s joint-second warmest winter on record. It is estimated that around 20bn m3 of gas demand was reduced due to lower heating requirements. A future colder-than-normal winter would see potentially some of this demand come back, but with a strong relationship against price.

Both Europe and the US recorded falls in overall energy consumption in 2023, one of the factors behind signs of peaking or post-peak fossil fuel demand across their economies. In Europe, fossil fuels in 2023 fell below 70% of primary energy consumption for the first time since the industrial revolution. In absolute terms, Europe’s fossil consumption fell by 6% last year and coal consumption has halved over the last decade. In fact, in 2023 fossil fuel consumption did not increase in a single European country. It would take a major unexpected change for Europe to revert from this course.

In the US, consumption of fossil fuels fell by 2% to just over 80% of total primary energy consumed. Notably, coal consumption fell by 17% in 2023 and has more than halved since 2013. Much coal consumption has been displaced by increased gas use. The US seems likely to follow the European trend.

Notably, however, transportation fuels did not follow this track. Combined, petrol (gasoline) and diesel have fallen around 1% in both markets but both saw upticks in gasoline demand (1.5% US and 5% Europe). Moreover, despite the increasing sales of EVs, numbers are still too low to have a material impact on fuel demand. Also, the post-COVID responses of the Inflation Reduction Act in the US and the EU Green Deal have accelerated investment in many forms of clean energy but this has yet to flow through materially in terms of generation figures.

Europe’s demand for gas amounted to 30% of total world intra-regional trade, and just under 31% of global LNG imports in 2023. That has imposed a cost in carbon to developing nations, which continued to grow coal consumption. For example, in India, although gas consumption in 2023 increased by 7%, coal consumption grew by 10%, and in absolute terms the growth in coal alone was nearly as high as India’s total gas consumption.

African primary energy consumption

Against a backdrop of 2% growth in primary energy consumption, in the 54 countries and 1.4bn people of the African continent, primary energy consumption fell in 2023 by 0.5%, and electricity consumption was flat. Fossil fuels accounted for 90% of overall energy consumption.

Whilst renewable generation (excluding hydro) grew at 12%, it is from a tiny base – representing just 6% of electricity (excluding hydro). Hydro is more significant, at around 18% of African power generation, and this benefited from a 3% increase in 2023.

Energy Institute Chief Executive Nick Wayth says: ‘There is a common cliche that circulates about the energy transition in developing countries, such as those in sub-Saharan Africa, that they must decarbonise before they can decarbonise. But on the basis of this evidence, they are neither carbonising nor decarbonising.’

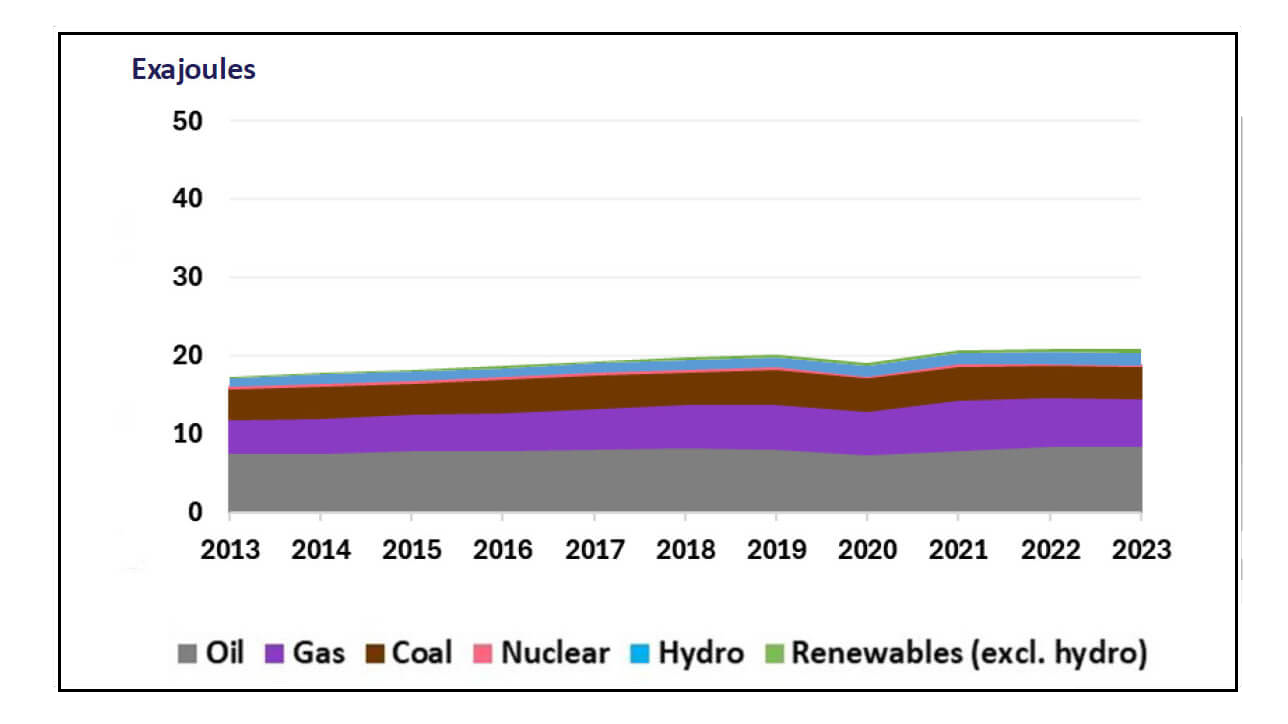

Primary energy consumption in Africa, 2013–2023

Primary energy consumption in Africa, 2013–2023

Source: EI Statistical Review of World Energy

Contrasting trends in India and China

In India, fossil fuel consumption continues to accelerate, up 8% in 2023, accounting for almost all of demand growth. Coal, oil and gas have remained remarkably stable in market share terms over the last decade. These fossil fuels together account for 89% of energy consumption. Notably, in electricity, 96% of the net power generation additions in India in 2023 were from fossil fuels. Renewables added 23% of net additions, but this was offset by a sharp fall in hydro. Whilst India may be broadly on track to meet its 450 GW renewable target by 2030, this is far from sufficient to cover the overall increase in power demand – without increased fossil generation.

It was another big year of growth for China, which for the first time overtook Europe in terms of per-capita energy consumption. The east Asian giant, which houses a sixth of the world’s population, is responsible for nearly 30% of global energy. In a year after COVID lockdowns, fossil fuel consumption rebounded 6% year-on-year to a new high, driven by increases in crude and coal use.

Renewables growth continues

China accounted for over half (55%) of the global additions in renewable energy generation (which is almost entirely wind and solar, and grew in total 13% to 4,748 TWh – reaching 8% of primary energy use). China’s growth alone amounted to more than twice the total for Europe, India and the US combined. In installed capacity terms, China accounted for 63% of the global additions in wind and solar.

China’s renewables accounted for nearly half (49%) of net additions to Chinese electricity consumption. Extrapolating the historic five-year average growth rate on overall electricity consumption and renewable electricity would result in two-thirds of electricity net growth from renewables in 2024, nearly 100% of net growth from renewables in 2027 and 150% of net growth from renewables by 2030. This is not a forecast, but gives a sense of the rate of China’s growth in renewable power, and its potential role in meeting the COP28 goal of tripling renewable capacity by 2030.

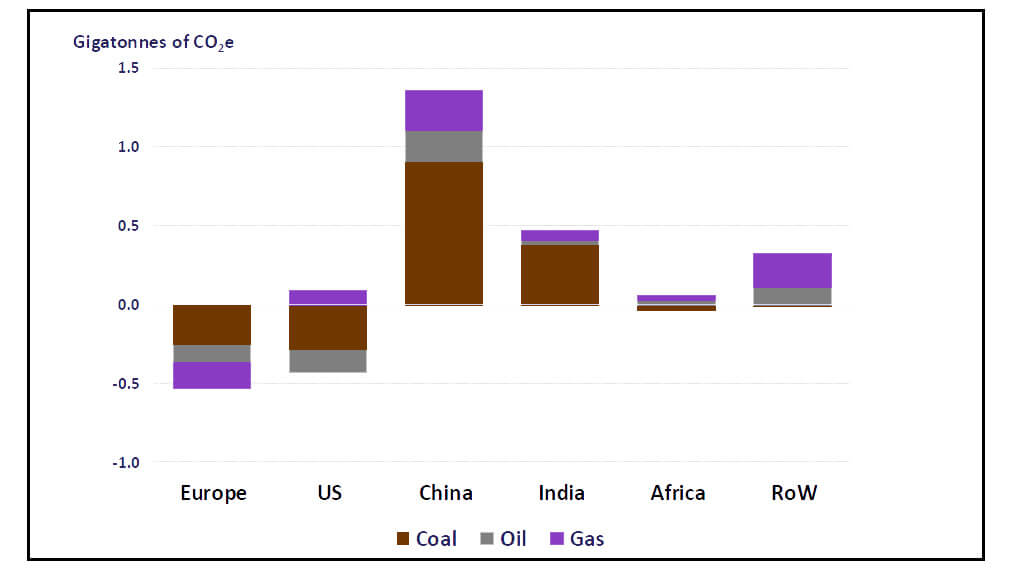

Regional changes in CO2e emissions by fuel, 2019 versus 2023 – while Europe and the US are decarbonising, India and China continue to invest in fossil fuels

Regional changes in CO2e emissions by fuel, 2019 versus 2023 – while Europe and the US are decarbonising, India and China continue to invest in fossil fuels

Source: EI Statistical Review of World Energy

Reflecting on the results, Energy Institute Chief Executive Nick Wayth CEng FEI FIMechE says: ‘At the global level, the new data provides little encouragement in terms of global climate change mitigation. Clean energy is still not even meeting the entirety of demand growth and therefore at a global level not displacing fossil fuels. Arguably the transition has not even started.’

‘But as has been seen, this is masking a granularity – ranging from the major advanced economies of Europe and the US, where fossil demand is likely to be peaking, to the still-carbonising growth economies of the Global South.’

The Statistical Review of World Energy has been providing timely, comprehensive and objective data to the energy community since 1952, originally from BP and, since 2023, under the custodianship of the Energy Institute and its co-authors KPMG and Kearney. Data compilation is undertaken by Heriot-Watt University and additional support is provided by Knowledge Partner S&P Global Commodities and, during the transition period, by BP. This year, new data sets were launched in areas of growth interest: in battery storage and cells, carbon capture, hydrogen, ammonia, uranium and additional key minerals and materials. The report and data are now available online.

- Further reading: ‘Fuelling change: the surge of US LNG’. As the start of the 21st century witnessed growing dialogues around climate change and recognition of the need for renewable energy sources, a contrary trend has emerged from the heart of the US: an upsurge in LNG production. This phenomenon not only marks a significant pivot in the US energy narrative, but also casts a long shadow on the global dialogue concerning environmental sustainability and the transition towards greener energy paradigms.

- With more than 30 sessions on energy scenarios, energy finance, making a just transition, technological innovation and electrification, International Energy Week 2024 covered lots of ground. One session in particular encompassed the widest possible scope, addressing the global energy situation and outlook.