UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Global grid infrastructure needs to more than double by 2050 to meet surging electricity demand

26/6/2024

News

Global electricity demand is forecast to double by 2050, requiring extensive expansion of electricity grids and technological upgrades, according to a new report from DNV. Meanwhile, the World Economic Forum says energy transition momentum is slowing amidst global uncertainty, but reports from SolarPower Europe and the Global Wind Energy Council highlight some record-breaking renewables statistics.

DNV new power systems report

Economic growth and the electrification of transportation, heating and industry are expected to result in a doubling of global electricity demand by 2050, according to a new report from DNV. Electricity is forecast to account for 37% of global final energy use by 2050, a rise from 20% in 2023, with renewables, in particular wind and solar, anticipated to meet 70% of the demand.

Significant grid expansion, enhancements in grid management, solutions for grid congestion and new business models will be needed to create the flexible and robust demand-response system that will be required to accommodate this increasing demand for electricity and the shift away from fossil fuels.

Fluctuating demand from sectors like heat and transport will call for new ancillary services such as synthetic inertia products, while advanced technologies such as artificial intelligence (AI) and automated activation of demand response will assist grid operations and market predictions, continues the report.

It also says that energy storage will have a key role to play in meeting the intermittent nature of renewable energy sources, providing grid balancing and managing load. Lithium-ion battery technology is expected to dominate this sector, offering three times more storage capacity than hydropower and pumped storage by 2050. Power-to-hydrogen value chains are also regarded as ‘a critical market element for renewable generation’ but will ‘need to be scaled through concerted investment efforts by all stakeholders’.

The report states that global grid capacity needs to grow 2.5 times its current size, with annual expenditure on grids more than doubling to $970bn by 2050. It adds that, while ‘grid enhancing technologies offer potentially significant temporary relief’, the ‘long-term solution lies in accelerating the construction of new grid infrastructure and advanced controlling systems, which are currently hampered by permitting timelines, the scarcity of human and material resources, and financial constraints’.

However, the report suggests that grid expansion ‘is affordable, due to growing efficiencies in grid technology and the increased electricity load’, with DNV expecting global grid charges passed to consumers to remain stable or decline in the long term.

‘There will be no transition without transmission,’ comments Ditlev Engel, CEO for Energy Systems at DNV. ‘The new energy system will require data-driven solutions and policies that address all interconnections, from permitting to the integration of AI and cyber-resilience… The pathway to a decarbonised power system is clear: renewables integration and grid expansion require significant investment, innovation, coordination and commitment from all players, especially governments.’

Energy transition momentum slowing amidst global uncertainty

Meanwhile, a new report from the World Economic Forum (WEF) suggests that the global energy transition has ‘lost momentum in the face of increasing uncertainty worldwide’, with economic volatility, heightened geopolitical tensions and technological shifts all having an impact.

The report benchmarks 120 countries on the performance of their current energy systems, with a focus on balancing equity, environmental sustainability and energy security, and on their transition-readiness.

European countries lead the rankings, with Sweden coming top, followed by Denmark, Finland, Switzerland and France. These countries benefit from high political commitment, strong investments in research and development, expanded clean energy adoption – accelerated by the regional geopolitical situation, energy-efficiency policies and carbon pricing. France is a new entrant in the top five, with recent energy-efficiency measures reducing energy intensity in the past year.

Emerging economies such as Brazil and China have made ‘notable progress’, primarily driven by long-term efforts to increase the share of clean energy and enhance their grid reliability. Brazil’s ongoing commitment to hydropower and biofuels, recent strides in solar energy, along with initiatives tailored to create new opportunities have been key in attracting investments, reports the WEF. In 2023, China also significantly scaled up its renewable energy capacity and continued to grow and invest in its manufacturing capability in clean technologies such as batteries for electric vehicles, solar panels, wind turbines and other critical technologies. China, together with the US and India, is also leading in developing new energy solutions and technologies, notes the report.

The report highlights that 83% of countries moved backwards from last year’s rankings in at least one of the three energy system performance dimensions (security, equity and sustainability).

It also suggests that the ‘gap in energy transition performance between advanced and developing economies continues to narrow, although disparities in investments and regulation remain’.

‘We must ensure that the energy transition is equitable, in and across emerging and developed economies,’ comments Roberto Bocca, Head of the Centre for Energy and Materials, WEF. ‘Transforming how we produce and consume energy is critical to success. We need to act on three key levers for the energy transition urgently: reforming the current energy system to reduce its emissions, deploying clean energy solutions at scale, and reducing energy intensity per unit of GDP.

The UK ranks 13th, China 17th and the US 19th. The bottom-ranked country is Congo.

Global solar installations almost double in 2023 but leave emerging economies in the dark

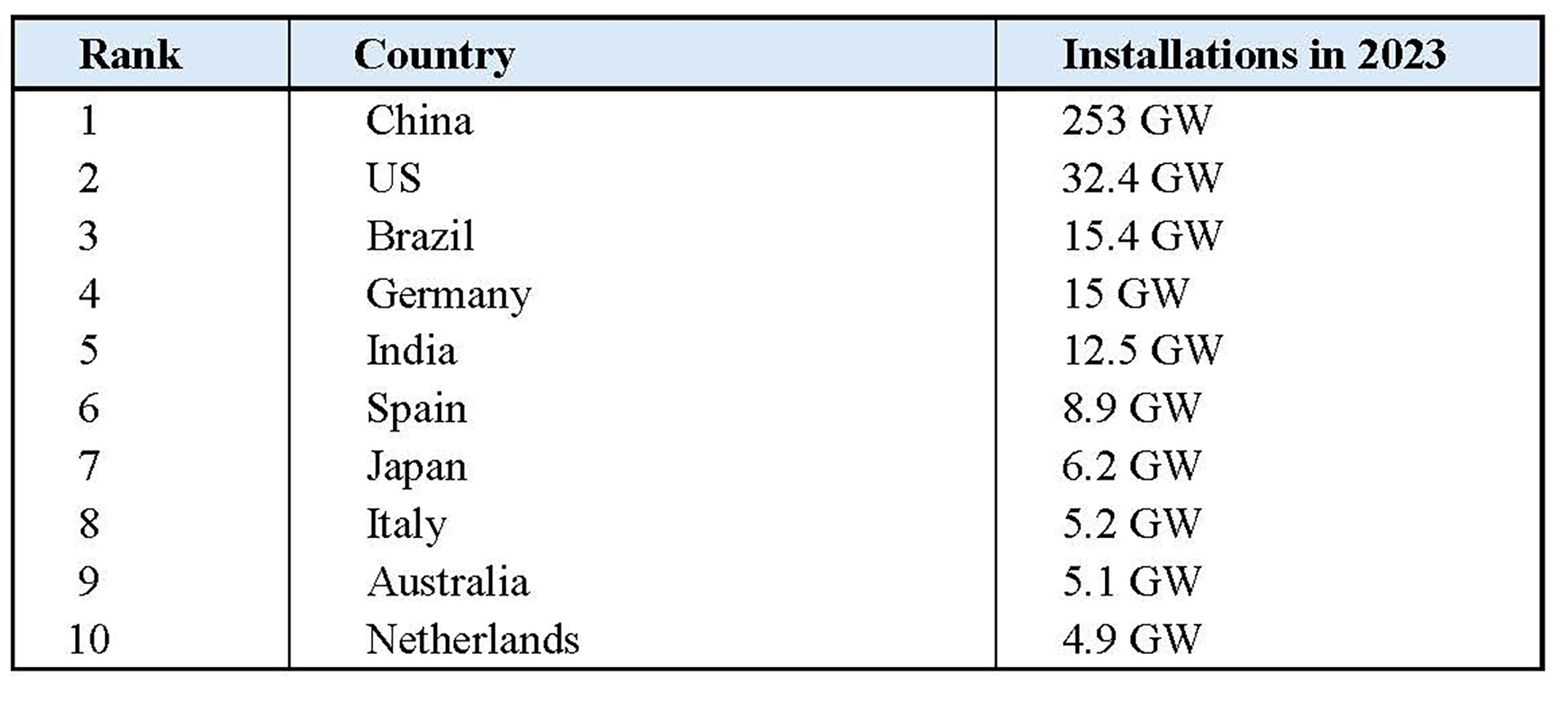

The disparity between advanced and developing economies is also flagged up in a new report from SolarPower Europe. It found that 80% of global solar installations in 2023 were concentrated in the top 10 markets, which disproportionately included advanced economies (see Fig 1).

The report says global solar yearly installations increased in 2023 by 87% in 2022, ‘rates not seen in over a decade, since 2010 when the global solar market was only 4% of what it is today’. Some 447 GW of new solar was brought online, compared to the 239 GW installed in 2022, bringing the world’s total solar capacity to 1.6 TW.

China dominated global solar growth, installing 57%, 253 GW, of the world’s solar in 2023, equivalent to the levels installed globally in 2022. On the manufacturing side, a massive scale-up of capacity led to solar panel price collapses of around 50% last year and a growing consolidation of the solar manufacturing industry in the country.

‘China continues to set the pace of the global solar transition,’ comments Sonia Dunlop, CEO of the Global Solar Council. ‘But to keep 1.5°C alive, it is more important than ever that we stay united as an industry. No one country or company can achieve this goal on their own. We must work together to build new markets with untapped potential, create fair and resilient supply chains, and inject massive amounts of finance for solar to lead the energy transition.’

To better understand solar developments in China, the report covers the country in a dedicated chapter, provided by the Global Solar Council and its member, the Chinese Renewable Energy Industries Association (CREIA).

The world is likely to achieve 2 TW of total solar this year, after reaching 1 TW in 2022, forecasts the report. It predicts that by 2028 the world could be installing 1 TW of solar a year, but ‘financing and energy system flexibility must be unlocked’ to achieve this. Some $12tn will be needed to deliver the COP28 target of tripling global renewables capacity by 2030, notes the report; solar is expected to deliver half this target.

(See also, last week’s news story on Wood Mackenzie forecasting that China will have enough module manufacturing capacity by 2027 to meet global demand twice over.)

Fig 1: Top 10 Solar Markets in 2023

Source: Global Market Outlook for Solar Power 2024–2028, SolarPower Europe

Strong offshore wind growth in 2023 as industry sets course for record-breaking decade

Meanwhile, the offshore wind sector is poised for further global growth, according to a new report from the Global Wind Energy Council (GWEC). 2023 saw the second-highest annual installations as well as key policy developments that set the foundations for accelerated expansion of the industry over the next decade.

In 2023, despite the macroeconomic challenges faced by the sector in some key markets, the wind industry installed 10.8 GW of new offshore wind capacity, taking the global total to 75.2 GW. New capacity increased 24% on the previous year, a growth rate the GWEC expects to ‘continue up to 2030 if the present increase in policy momentum continues’.

In the next 10 years, the report forecasts that 410 GW of new offshore wind capacity will be installed, bringing offshore wind deployment in line with Global Offshore Wind Alliance targets to install 380 GW by 2030. The majority of that will come at the turn of the decade, with two-thirds installed between 2029 and 2033.

This anticipated growth will be driven by the arrival of the next wave of offshore wind markets like Australia, Japan, South Korea, the Philippines, Vietnam, Brazil, Colombia, Ireland and Poland – where ‘policy developments and unprecedented focus across governments, industry and civil society is setting the conditions for long-term offshore wind development at scale’.

The report outlines a ‘Global Growth Framework for Offshore Wind’ for industry and governments planning to rapidly scale up development, covering finance, demand and industrial offtake, supply chain development, permitting, social consensus, workforce development and grid infrastructure. GWEC’s position is that forecast growth is ‘at risk if this framework is not implemented’.

Ben Backwell, CEO, Global Wind Energy Council, comments: ‘Installing almost 11 GW of offshore wind is the leading edge of a new wave of offshore wind growth. Policy progress – especially across the Asia-Pacific region and the Americas – has set us on course to regularly install record-breaking capacity annually. That means offshore wind is on course to achieve the tripling ambition set at COP28 in Dubai.’