UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

The potential of geothermal energy in Europe

29/5/2024

8 min read

Feature

In January, the European Parliament heard and adopted a resolution calling for a European strategy on geothermal energy tabled by Poland MEP and University of Bremen Professor Zdzisław Krasnodębski. An edited version of the attached explanatory note is below. The resolution calls for mapping geothermal assets, launching an industrial alliance on geothermal energy, and the introduction of a harmonised insurance scheme to mitigate financial risk for the sector, according to a Euractiv report.

The development of geothermal energy is hindered largely by limited knowledge about existing technologies and their potential, particularly for shallow geothermal development, among policy makers, local authorities, economic actors and the general public. Other challenges are of a financial, legal and technical nature.

While new technologies significantly expand the cost-efficient application of geothermal solutions, differences in geological and climate conditions between European Union (EU) member states are the reason why the costs of deployment of similar projects differ due to, for example, the need for deeper drills, use of geothermal heat pumps and associated infrastructure.

Resource mapping

One of the most important challenges for geothermal is the lack of sufficient geothermal resource mapping. There are industry calls for a solution to ensure that all subsurface data is collected in one place (including the location of decommissioned oil and gas wells) and made available for the public. Practices on data sharing diverge across EU member states.

Assessment of deployment of geothermal energy in Europe is very difficult due to the lack of standards for industry data reporting. Therefore, it is difficult to understand whether particular regions are advanced in deployment of geothermal and to which extent EU funding was used for these purposes. In the EU databases, geothermal is categorised as ‘other renewables’ where it is aggregated with hydro projects. National and EU authorities agree that there is a mismatch in reported data and, generally, the deployed geothermal is underestimated.

While power generation is quite well documented, there is a problem in reporting on heating and cooling. These fragmented values and the lack of common standards lead to an under-representation of the geothermal industry in the energy market.

High capital investment

Geothermal installations are characterised by low operational expenditures but high capital investment, primarily due to the high cost and risk of exploration drilling. Explorers can also come across imperfect wells – failure rates range from less than 10% in Hungary and Germany to 30% in the Netherlands, according to analysts at Rystad Energy.

Market financiers generally are unwilling to carry these early-stage risks and costs, while municipalities that often foot the bill, as they are usually in charge of local district heating, feel skittish about suffering potential losses.

These subsurface resource risks and associated financial costs represent one of the major barriers for geothermal project developers. Government policies that lower risks are therefore crucial to incentivise private sector financial investment. De-risking instruments can take many forms and be designed according to the overall maturity of the market. There are already good examples of such instruments in some member states. In August 2023, the European Commission approved under EU state aid rules a French aid scheme to set up a guarantee fund for deep geothermal operations.

While new technologies significantly expand the cost-efficient application of geothermal solutions, differences in geological and climate conditions between EU member states are the reason why the costs of deployment of similar projects differ.

Fragmented regulations

Regulations are complex and fragmented between member states, and coupled with long and complex authorisation, slow down geothermal deployment. While the revised Renewable Energy Directive simplifying the permitting rules is a step in a good direction, it covers only surface projects, such as heat pumps, and leaves aside subsurface activities. In particular, there are problems with the mining law, which was designed for large mining activities and not for projects of smaller scale, such as geothermal.

Heat pumps and geothermal energy technologies are categorised as ‘strategic net zero technologies’ by the Net Zero Industry Act. While the EU is leading in research and development and manufacturing of geothermal technologies, and has a reliant supply chain, funding support measures are needed for the next-generation geothermal technologies, particularly in geothermal storage, industrial applications and geothermal lithium. In this context, it is important to note the recent award of an €91.6mn grant from the European Innovation Fund to Eavor’s next-generation geothermal project in Bavaria.

Skills gap

Completion of planned projects and development of new ones will not be possible without sufficient numbers of qualified workers. Therefore, in order to keep the pace of geothermal development to meet the objective stated in the EU Solar Energy Strategy about tripling energy demand covered by geothermal, there is an urgency to invest in skilling and reskilling the workforce for this sector.

The Geo3En programme, a project supported by the EU-funded Erasmus+ initiative, aims to remedy the lack of qualified junior graduates in the geothermal energy value chain, and that lays the foundation for a future Erasmus Mundus Master’s degree in geothermal engineering.

Recent projects

The potential of geothermal development using infrastructure formerly used by hydrocarbon industry is not yet fully tapped by member states. However, there are several successful projects across Europe where decommissioned coal mines have been repurposed for geothermal heating and cooling.

The recent Hunosa project in Asturia transformed an old coal colliery into the largest geothermal district heating system in Spain. Meanwhile, promising work is underway on the use of decommissioned oil and gas wells for geothermal applications, some of them carried out by hydrocarbon companies themselves. There is a need for dedicated policies, legal and support framework, and specific actions that would enable and advance the transition from fossil fuel-producing regions to sustainable growth, through geothermal energy use.

Despite its benefits, geothermal energy is often perceived as a niche technology that is expensive, complex or only suitable to territories with very rare particular geological qualities. Geothermal energy also faces competition from other renewable or conventional sources of energy that may have more established markets, policies or subsidies. To overcome this barrier, geothermal advocates together with EU member states need to increase the visibility and credibility of geothermal energy, by showcasing its benefits, costs and performance, and by engaging with relevant stakeholders and communities.

There is a growing national awareness towards supporting geothermal. A number of member states, such as France, Poland and Ireland, have developed roadmaps, targets and dedicated policy measures to support geothermal.

Geothermal market trends

As a mature technology, geothermal can generate electricity, heating, cooling and hot water. Philippe Dumas, Secretary General at trade organisation European Geothermal Energy Council (EGEC), considers the geothermal market trends in Europe.

Last winter, geothermal energy provided heating and cooling to more than 16 million people in Europe, and electricity to about 11 million consumers. More than 2.2 million geothermal heat pumps are installed in Europe. They consist largely of small-scale units of around 10 kWth capacity, supplying heat, cold and hot water to single-family homes. However, there is an increasing trend towards larger systems of 50 kWth to 1 MWth to supply heat and cold to residential and tertiary buildings, including offices, swimming pools and supermarkets. Once installed, geothermal systems also supply free cooling, especially to large consumers such as data centres.

During 2022 there was an all-time high in the sales volume of geothermal heat pump systems, surpassing the previous record set in 2021. With over 141,30 geothermal heat pump systems installed, sales in 2022 were 17% higher than the previous year. This upward trend has already been confirmed in 2023, particularly in Germany and Sweden.

About 400 geothermal district heating systems are in operation in Europe. They mainly supply heat to for consumers in urban areas such as residential buildings, but also for agriculture, in particular greenhouses. Soon 10% of the greenhouses in the Netherlands will be heated by geothermal sources.

More than 300 geothermal district heating projects are in development, with an average size of 10 MWth capacity to supply 10,000 heat consumers. Large heat pumps, new drilling designs and technologies, and innovative business models are accelerating the deployment of geothermal systems. There is also a trend to supply heat to industrial processes.

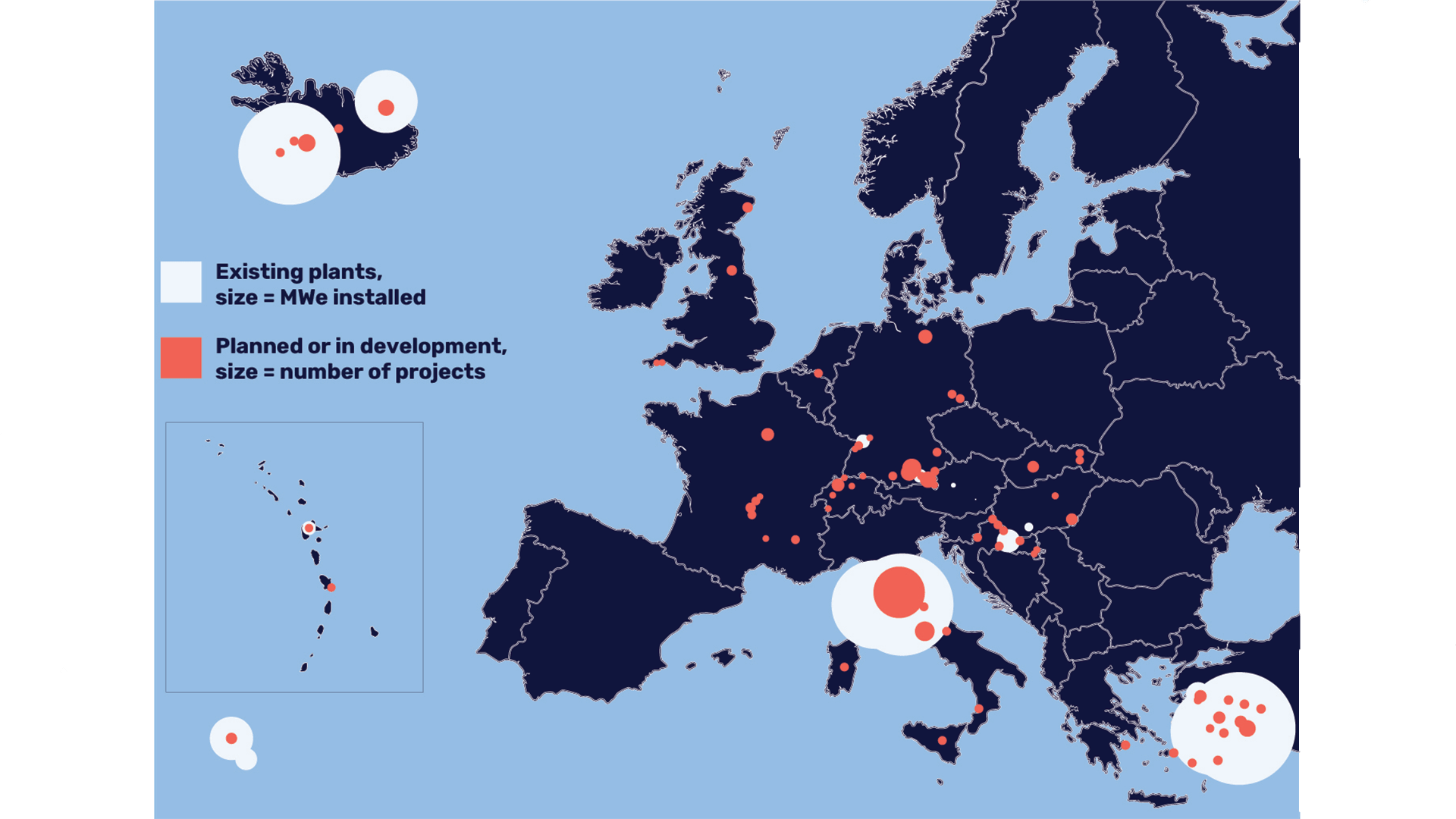

About 150 geothermal power plants are installed in Europe, representing a capacity of 3.5 GWe. Geothermal power is a base load technology; power plants run typically at around 8,000 h/y, typically with a load factor in excess of 80% – the best load factor of all sources of electricity. Given the need for more capacity flexibility in the grid because of renewables, geothermal power plants can also become dispatchable.

Geothermal base load electricity generated more than 22 TWh in Italy, Iceland, Turkey, Croatia, France, Germany, Hungary, Austria and Portugal. New capacity is being installed in Belgium, Slovakia, Greece, Switzerland and the UK. Many plants are to be put into operation within the next five to seven years.

For a cost-competitiveness analysis, cost comparison with other sources of energy must include levelised costs of electricity, system costs, externalities with sustainable and resilience criteria. Lifetime is a key criterion: around 50 geothermal power plants are more than 15 years old and some are more than 25 years old.

Geothermal minerals are by-products of geothermal energy activities. They are extracted from brines that carry heat and minerals. As a common battery material, lithium is vital for decarbonising transport.

The geothermal sector has designed and piloted methods to extract lithium from geothermal systems without hampering their energy generation activities. Many projects and exploration activities are already in process in Germany, France and Italy.

Geothermal energy could have a significant role to play in the energy transition, offering affordable heating, cooling and electricity in addition to a well-established path to reducing emissions. The path is clear and the obstacles are known. However, the pace at which Europe becomes climate neutral depends to a certain extent on how quickly these are addressed.

Fig 1: Existing, planned and under development geothermal power plants in Europe

Source: EGEC

- Further reading: ‘Cornish deep hot rock developments’. Geothermal Engineering aims to deliver 25 MW of renewable baseload electricity and 100 MW of renewable heat across its portfolio from deep geothermal resources in the UK by 2028. The company currently has three sites under development in Cornwall, at United Downs, Penhallow and Manhay.

- ‘Kenya’s path to universal power – a blueprint for sub-Saharan Africa?’ Over half of sub-Saharan Africans live without electricity access – and this situation has worsened recently. However, there is regional disparity and some countries, such as Kenya, have achieved impressive energy access levels.