UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Trends in the 2023 UK fuel retail market

24/4/2024

8 min read

Feature

The Energy Institute’s (EI) Knowledge, Insights and Research team has gathered a wealth of UK forecourt and electric vehicle charging point data as part of the latest Retailing Market Survey (RMS). Here, Claire Cortis AMEI, Digital Knowledge and Information Manager, discusses the emerging trends.

The uncertainty in 2022 caused by continuing COVID-related supply chain issues and the Ukraine war that affected the retail fuel industry continued to be felt in 2023. Whilst fuel prices fluctuated wildly, prompting closer scrutiny by the UK government’s Competition and Markets Authority (CMA), electric vehicles (EVs) continued to rise in popularity. Their market share continued to increase, so did the number of charging points across the UK. These trends are reflected in the latest EI’s Retail Marketing Survey.

Fuel prices and sales

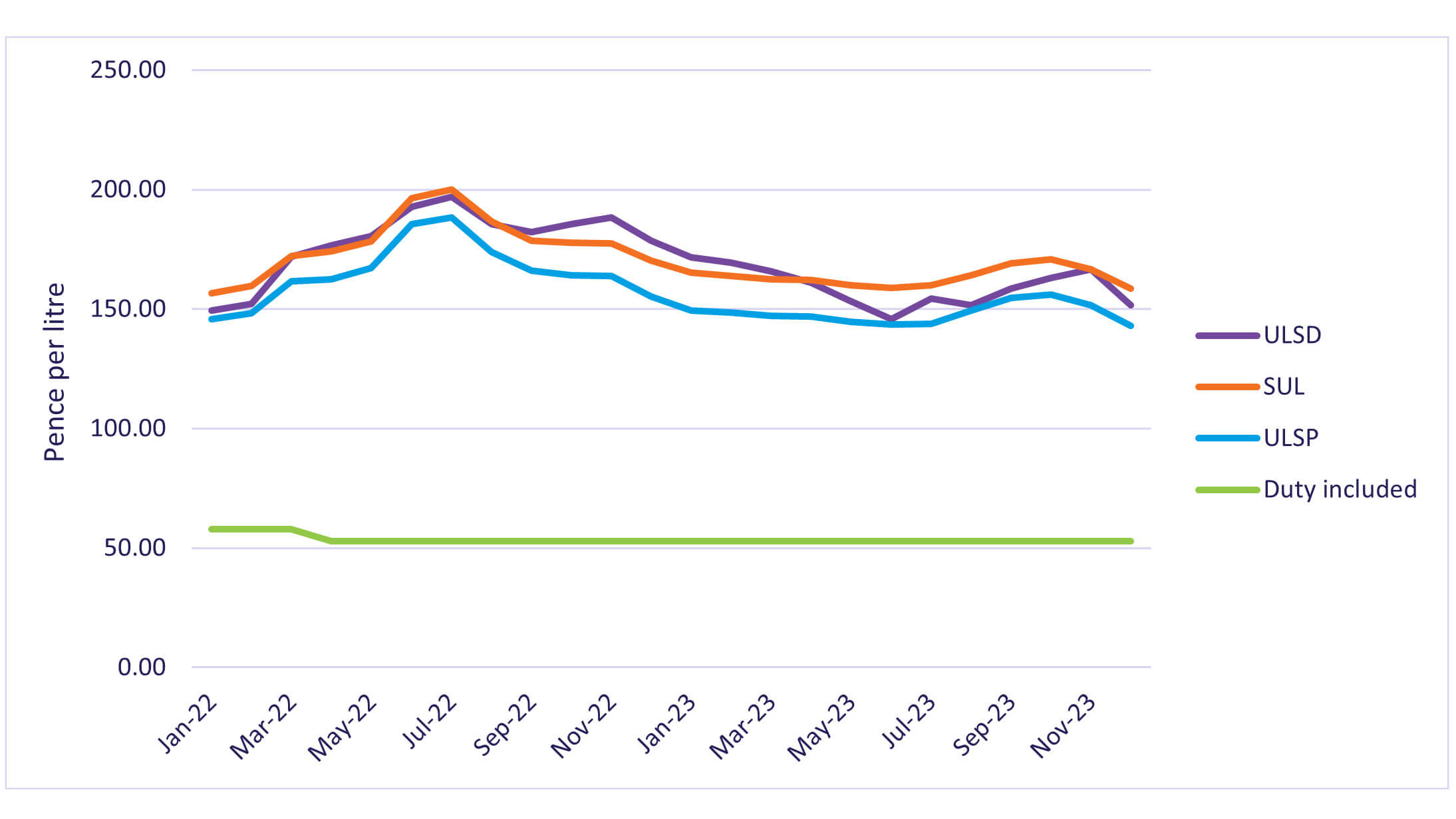

The second highest fuel forecourt price spike in history occurred in 2023, beaten only by prices in the previous year. The average price of unleaded petrol was 148.27 pence per litre (p/l) and the average price of diesel was 159.45 p/l, making unleaded petrol on average 10.3% cheaper (16.94 p/l cheaper) and diesel on average 10.6% (18.93 p/l cheaper) than in 2022 (see Fig 1).

Fig 1: Average petrol prices in the UK, 2022–2023

Source: Experian Catalist

Fuel prices continued to fall in the first half of 2023 due to falling crude oil prices. In June 2023, unleaded petrol reached a low of 143.55 p/l and diesel reached a low of 145.87 p/l. Oil prices then began to rise after major oil producers restricted production, causing petrol prices to rise until November. Petrol prices then fell to the lowest they’d been in just over two years. Diesel prices followed a similar trend, rising and then falling in December.

In the 2023 Spring Budget, the government announced that it would extend the 5 p/l reduction in fuel duty for another 12 months in a bid to save motorists around £100 on average over the course of the year. This decision reflected continuing concerns over inflation remaining high and fluctuations in pump prices due primarily to the war in Ukraine.

However, there were ongoing concerns that retailers were not passing on the 5 pence reduction to consumers, with the CMA publishing a report on 3 July 2023 that found consumers were paying higher prices for fuel than prior to the COVID pandemic due to weakened market competition. The CMA also concluded that fuel retailers’ margins had increased, especially for diesel. Supermarket brands had the highest margins, with customers paying an additional 6 p/l. However, they found no evidence to suggest fuel retailers had been price fixing.

The government agreed to the CMA’s report recommendations that a fuel finder scheme be put in place where consumers could access real-time fuel prices, and to implement a new statutory body to monitor the fuel market. Since August 2023 there has been a temporary, voluntary fuel price data scheme in place.

After calls from the Society of Motor Manufacturers & Traders (SMMT) to delay EU-UK tariffs that would increase EV import costs, an agreement was reached and current trade rules on EVs extended to the end of 2026. This is expected to save manufacturers and consumers up to £4.3bn.

The UK ban on petrol and diesel vehicles was pushed back from 2030 to 2035, in what Prime Minister Rishi Sunak described as ‘a new approach to achieving net zero’, allowing consumers more time to switch to EVs and to improve charging infrastructure. Despite this, Nissan (which manufactures cars in the UK and Europe) has pledged to only sell EVs in Europe by 2030, citing it as ‘the right thing to do’, and is investing £2bn to produce two new EV models in the UK.

The EV market is continually evolving; for one example, in June 2023 the Ark Zero quadricycle went on sale for £5,995. Promoted as UK’s most affordable electric car, it has a top speed of 28 mph and a 50-mile range.

Vehicle registration figures reflect a big shift in the market in the past three years, and, although promising, the SMMT stated that the shift to EVs needed to accelerate further to help meet the UK’s net zero aspirations.

EV charging points

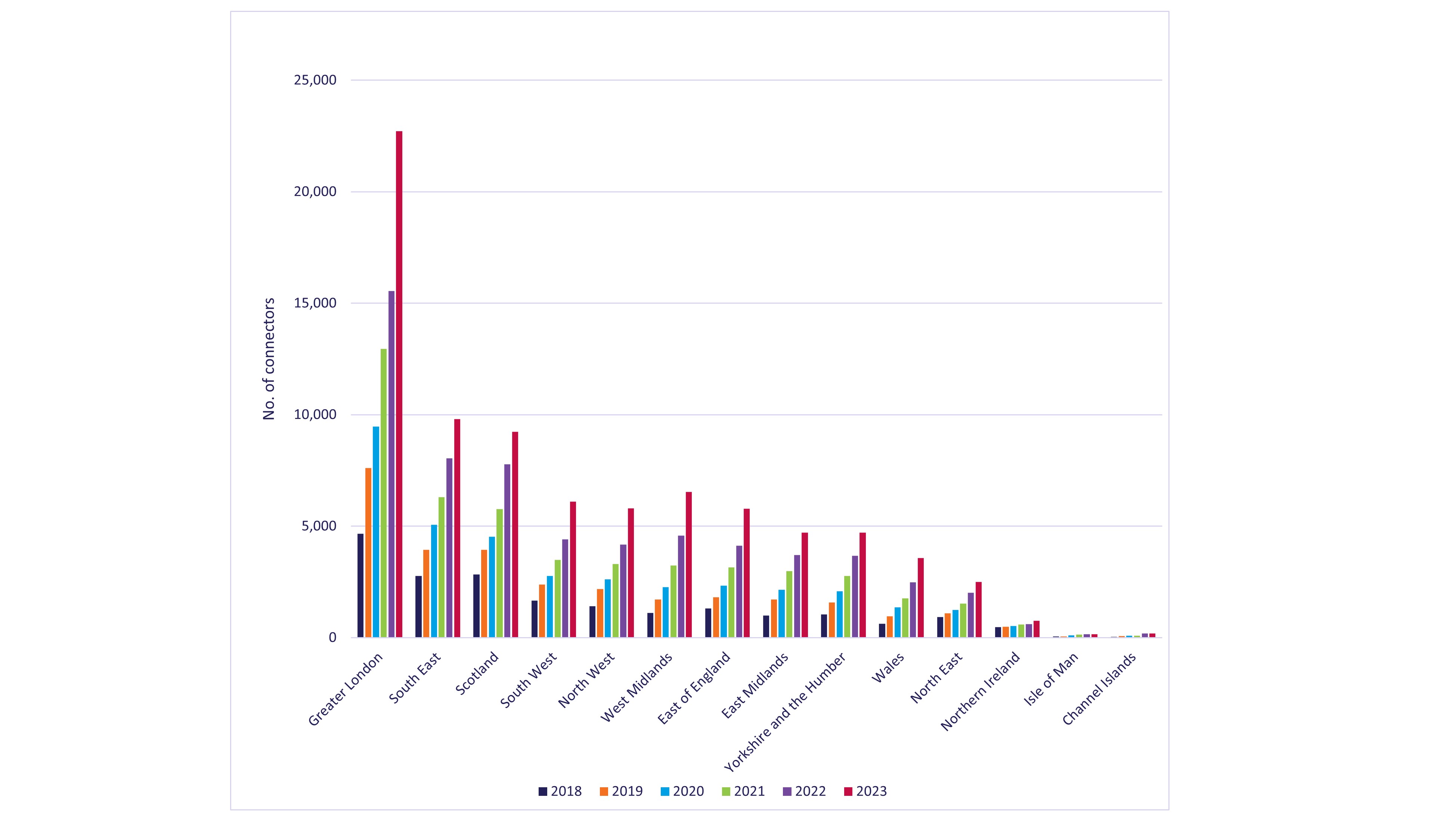

Information from Zap-Map shows that there has been an increase in the number of EV charging points across the UK from 61,493 in 2022 to 82,554 in 2023, a growth of 34%. Of these, 21,067, or 26% of charging points, were rapid chargers (43 kW+).

All regions, bar the Isle of Man where the number of charging points remained at 158, witnessed an increase in the number of charging points from 2022 to 2023. In 2023, Greater London had the most charging points at 22,722, a share of 27.5%. This was followed by the South-East with 9,809 charging points (11.9% share) and Scotland with 9,229 charging points (11.2% share). (See Fig 2.)

Fig 2: UK charging connectors by region

Source: Zap-Map

By the end of 2023, a major milestone was reached, with just over 50,000 public EV charge points having been installed. That was 44% more than the same time in 2022. Still, momentum needs to continue in order to reach the UK’s target of installing 300,000 public chargers by 2030; some analysts are casting doubt on whether the target will be met.

Meanwhile, the government continues to support the roll out of public charge points by giving local authorities in England access to the Local EV Infrastructure Fund, which supports the installation of charge points in local areas without off-street parking. At COP28’s Transport Day on 6 December 2023, a £70mn investment fund was announced to help upgrade motorway service networks with installing EV charge points.

Several interesting charging point projects were unveiled in 2023. First Bus became the first UK bus operator to install charging points for local EV users in one of its depots. It installed eight rapid chargers at its Summercourt depot in Cornwall in the summer. In September 2023, BP Pulse, the EV Network, and NEC Group opened the UK’s largest public EV charging hub at the NEC in Birmingham. Called the Gigahub, it has 30 ultra-fast and 150 fast charge points capable of charging 180 EVs at the same time. In Dundee in Scotland, SSE Energy Solutions began work on the Myrekirk roundabout, which will see 24 ultra-rapid charging points installed, with eight of these able to provide a range of 60 miles with only a three-minute charge time.

Future of electric vehicles

In September 2023, the government unveiled an ambitious regulatory framework for switching to EVs: the Zero Emission Vehicle (ZEV) mandate. It requires 80% of new cars and 70% of new vans sold in the UK to be zero emission by 2030 and 100% to be emission-free by 2035. The mandate came into effect on 3 January 2024 and requires by law that car manufacturers sell a certain number of zero emission vehicles each year, with heavy fines for those that fail to meet their targets. The mandate may see manufacturers reduce EV prices to attract consumers to purchase them so they can avoid fines. It will also accelerate the installation of charge points by inspiring confidence in investors.

Note: Charging point figures were supplied by Zap-Map. Its website also has a map of every EV charging point in the UK. Fuel retail statistics were supplied by Experian Catalist, although Allstar took over this service in April 2024.

- Further reading: ‘Hold-ups to UK electric vehicle charging infrastructure’. Cleaner and greener transport is a crucial part of the UK’s journey to net zero, and electric vehicles (EVs) have a vital role to play in this urgent transition. Melanie Shufflebotham, Chief Operating Officer, Zapmap, looks at the challenges facing the uptake of EVs in the UK.

- Find out more about Europe’s plans for alternative fuels infrastructure, including European Commission funding to support its development across the region’s main transport corridors and hubs.

EI Road Fuels Collection

The latest edition of the Retail Marketing Survey (RMS) is available as part of the Energy Institute’s Road Fuels Collection. This includes not only the UK fuel retail marketing statistics published since 1971, but also additional information covering the road fuels sector, from training courses to technical guidance.