UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Shades of green – colour coding the oil and gas company energy transition

22/11/2023

8 min read

Feature

Sustainable Fitch has developed a model to analyse the diverging pathways between various oil and gas companies on the path towards a low-carbon economy. Marina Petroleka, Global Head of Research at Sustainable Fitch, explains how the model works, highlighting wide disparities.*

Not all corporate low-carbon transition plans are of equal robustness, credibility and impact. There is a gap in the market where investors need nuance in their understanding of ostensibly similar pledges from companies in the same industry. While net zero and decarbonisation targets cover an ever-expanding swathe of the corporate landscape, there is a lack of visibility, scrutiny and, ultimately, credibility around the emission reduction action plans needed.

Notably, scrutiny of the recent net zero stocktake by Zero Tracker found that nearly 1,000 of the largest 2,000 companies have net zero targets. However, only 4% have a comprehensive plan in place covering all scoped emissions, with clarity on the use of offsets, short, medium and long-term roadmaps, and annual reporting.

These are the issues Sustainable Fitch’s Transition Assessment (TA) aims to address.

The TA is a tool built for investors who wish to engage in and help steward companies towards net zero objectives in so-called ‘hard-to-abate’ sectors, and want to be able to assess and compare companies’ transition plans on a like-for-like basis, going beyond the headline emission reduction or top line net zero target.

While net zero and decarbonisation targets cover an ever-expanding swathe of the corporate landscape, there is a lack of visibility, scrutiny and, ultimately, credibility around the emission reduction action plans needed.

Tailored methodology

Based on a framework developed by Sustainable Markets Initiative’s Transition Task Force, Sustainable Fitch designed a three-step assessment process to provide an informed, independent assessment of the transition ambitions, actions and net zero pathways of energy companies. The assessments are directly comparable and allow users to easily benchmark and comprehend the differentiation between companies.

- Step One is an analysis and scoring of the company’s disclosures and metrics on emissions reduction ambitions (for 2030 and 2050), delivered emissions reductions to date, and financial actions to enable transition, including investments.

- Step Two includes a series of adjustments related to the extent of systemic change around hydrocarbons exploration and production, and the relevance of the emissions information provided either at target or achieved level and governance.

- Step Three is a final safeguard-check to ensure that the assessment, as constructed in Steps One and Two, does not overstate the extent of the company’s transition.

The difference between decarbonising and going greener

Importantly, we differentiate between two pathways on reaching net zero, between decarbonising and greening of business activities. The former aims to reduce emissions to the commercially viable minimum through improvements in technology and efficiency gains in day-to-day operations, while offsetting the rest. Whereas the latter means to decarbonise, remove and also replace carbon-intensive assets or activities with low or no-carbon alternatives.

We are able to make this differentiation by considering capex (capital expenditure) and opex (operational expenditure) into, and revenues generated from, different areas, with investments earmarked for greening activities factored into the final assessment.

Throughout our assessment, company disclosures are critical and any lack of information or relevant and clear data on assessed areas gets marked down.

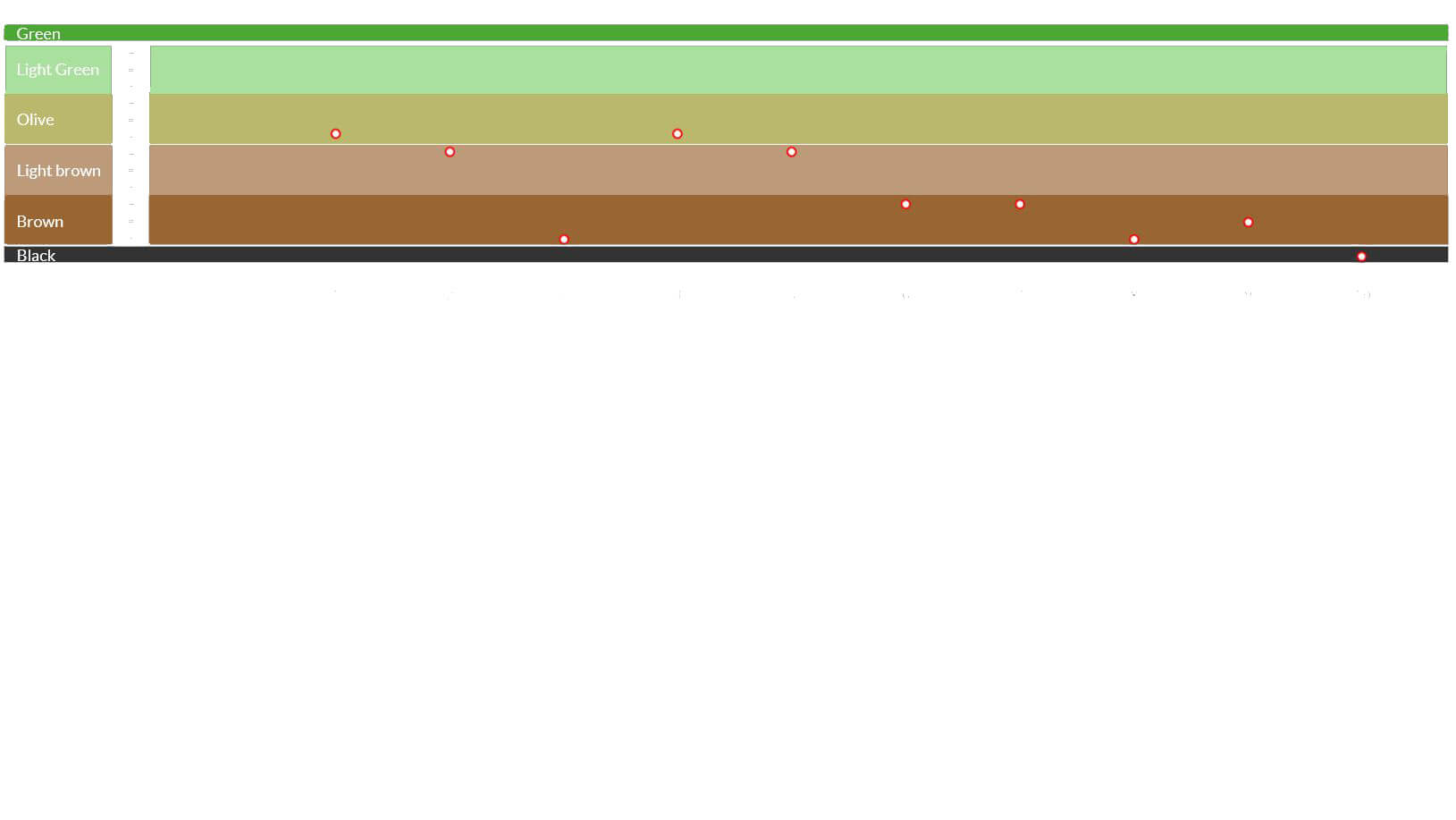

The end-result is a colour-coded score out of a possible 12-point scale that positions a company along the TA spectrum, with each colour representing a unique intermediate stage in a company’s transition pathway, from brown to light green (see Fig 1).

Fig 1: Colour-coded differentiation between decarbonisation and greening strategy

Source: SMI, Sustainable Fitch

A full explanation of TA methodology can be found here.

For our initial assessment we analysed 10 oil and gas companies, ranging from international oil companies (IOCs) to independents and national oil companies (NOCs). Within this cohort we have been able to observe and analyse vastly different approaches; ranging from commitments to pivot towards greening business activities and/or services, to a ‘business-as-usual’ approach with a focus on longer-term competitive cost advantages in upstream oil and gas and modest emissions reductions targets focused only around Scope 1 and 2 emissions.

Typically, the IOCs lead in olive, while independents and NOCs are in the light brown and brown transition categories.

The final assessments range from two of the 10 companies in olive, the highest score, both IOCs, one of them BP; to the lowest scored in black, an independent upstream operator, which indicates little or no intention towards decarbonisation. The rest of the companies, independents and NOCs, score in the light brown and brown range, which indicates some ambitions and, in some cases, delivered reductions on Scope 1 and 2 emissions primarily, and very limited disclosed financial actions on activities regarded as green or decarbonising within the broader investment and revenue mix. One IOC sits on the light brown segment, a result of safeguards applied in Step Three, which limited its score (see Fig 2 at end of the article).

Robust Scope 3 emissions ambitions remain elusive

Absolute Scope 3 emissions are typically the largest and most critical component of emissions from oil and gas companies, and our assessment indicates that disclosures on emissions ambitions from all relevant greenhouse gas (GHG) protocol categories still remain rare in the industry.

While some companies, typically IOCs in our sample, are disclosing the material GHG protocol categories (Categories 11: Use of Sold Products, and 12: End-of-life Treatment of Sold Products), others take a different approach such as disclosing Scope 3 emissions at each point in the value chain, or not calculating and/or disclosing at all. We find that to be particularly the case with NOCs and independents assessed who either do not disclose a Scope 3 net zero target to 2050 or are seeking a relatively modest reduction in Scope 3 emissions either over the medium (2030) or long-term.

Different approaches for measurement hinder comparison and standardisation, and also may hinder transparency.

For the IOCs in our sample we find that while their long-term net zero ambitions across all three scopes are the most robust, they can fall short in various ways. The perimeters can be limited, for instance only a portion of the business activities, or certain major geographies or only carbon but excluding methane and other gases. It is notable that in all companies we assessed, the 2030 target is more modest compared to what may be required to meet the stated 2050 target, or there is no intermediate target reported, which undermines the credibility of stated 2050 net zero objectives.

Use of carbon offsets has become a crucial area in the hard-to-abate sectors and in our methodology, offsets should be marginal. If not, there is a negative adjustment applied. Reliance on offsetting through carbon credits is an indication that a company does not have a clear pathway to achieving its emissions reduction targets.

Across our sample we find emissions ambitions for Scope 1 and 2 emissions to be more specific and disclosures on these more readily available.

Disclosures on delivered emissions

Disclosures on delivered emissions form an important part of our assessment, although Scope 3, as in ambitions, remain a challenging area. Reporting is either non-existent or non-verified and often goes back two or three years only. Where reported, we find that in most cases Scope 3 emissions have been rising in the short and longer term. Emissions reductions have been delivered more materially for Scope 1 and 2 emissions across the majority of the companies assessed, bar one where they have increased.

However, we also find companies having clear expansion plans to acquire further oil and gas assets. How these are accounted for comes into play whether these expansions are operated or equity stakes but non-operated. The latter does not count in emissions calculations, therefore a large increase in equity but non-operated fields will not be immediately visible. None of the companies assessed have stated that they will reduce or cease exploration and production activities for oil and natural gas.

Intensity lifecycle metrics, which cover Scope 1, 2 and 3 emissions, are also taken into consideration to offer a view on ambitions and delivered emissions. Although some companies are coalescing around a standardised way of disclosing the emissions intensity of their operations, others are including figures in the numerator which can flatter end-results by including avoided emissions, also known as Scope 4 emissions, as part of the overall assessment, which remains an ill-defined methodology. This means the company can show a reduced overall intensity figure output while potentially still having large Scope 1, 2 and 3 emissions.

While our methodology distinguishes between decarbonising and greening activities, only a few companies report clearly on the investments dedicated to decarbonising and/or greening. Those few in our cohort tend to be European Union (EU) based and disclosures are done based on the EU Taxonomy, which itself, however, still leaves various activities out of scope, therefore often out of the disclosure on capex, opex and revenues.

When looking for decarbonising activities, we refer to investments that would reduce carbon-intensive activities and products or remove emissions from activities and products. In the energy sector, examples include energy efficiency measures and electrification of operations. When looking for greening activities we would refer to investments that would replace activities and products with green alternatives. In the energy sector, a primary example would be investments in renewables.

While expanding renewables capacity is a prevailing approach amongst companies transitioning part of their operations towards net zero targets, we also found more specialised approaches. For example, one independent is looking to convert decommissioned oil and gas wells to store CO2 in an effort to diversify revenues away from oil and gas production, and in anticipation of a rising level of demand from carbon capture, utilisation and storage (CCUS).

Natural gas features often as a transition fuel. However, natural gas emits methane, and the EU Taxonomy only recognises it as transition under very specific, time limited scenarios. Other regional or country taxonomies might have a specific approach on natural gas based on displacement of other more polluting technologies. Our methodology does not consider investment in natural gas as transition, although shifting business models to natural gas might be reflected positively in some indicators as emissions might reduce following a decision to move away from oil towards gas products.

*Including article contributions by Ben Luckhurst and Alexandra Bettou.

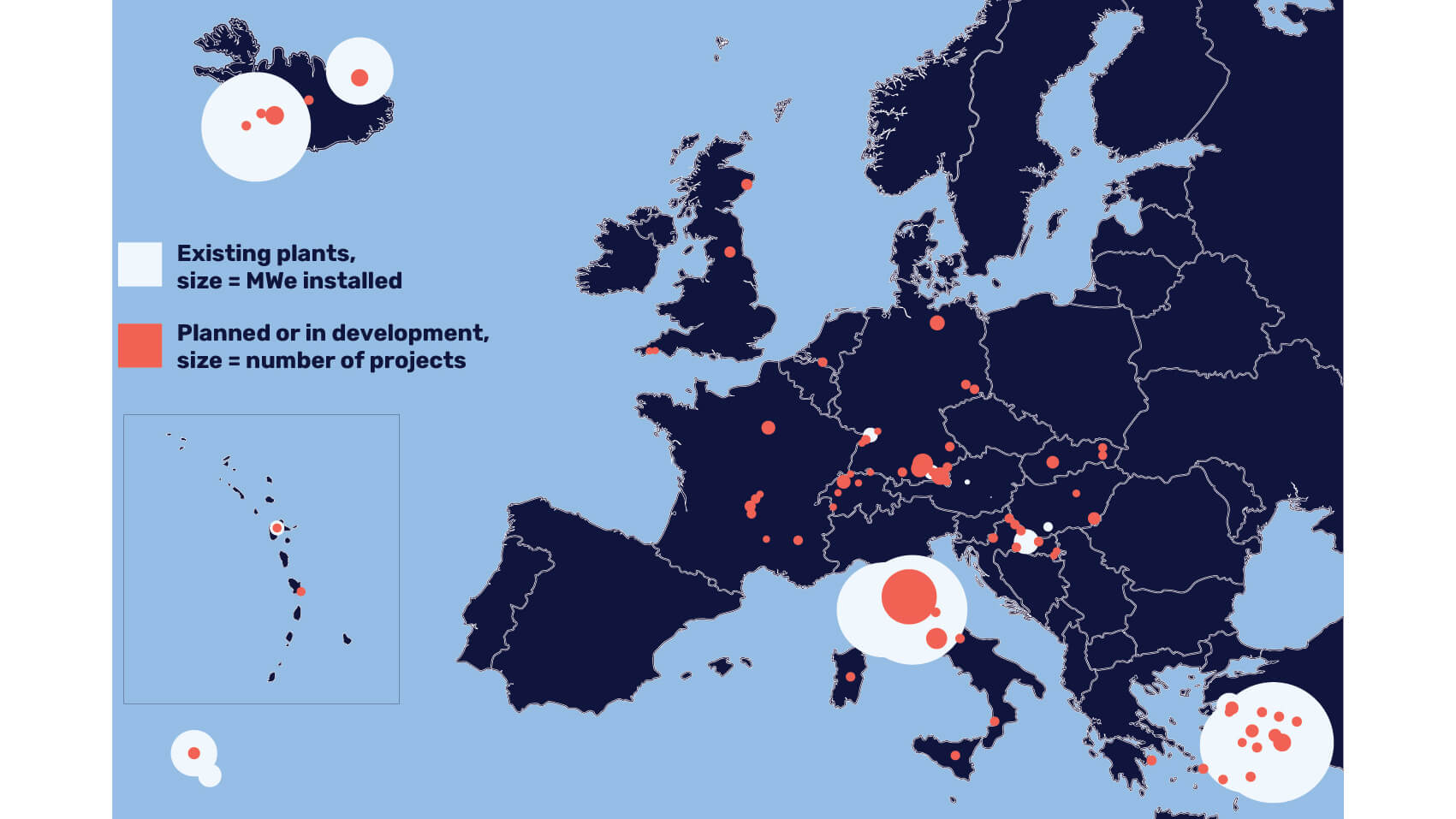

Fig 2: Distribution of transition initiatives across various oil and gas entities

Source: Sustainable Fitch