UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Australia’s shifting stance on hydrogen

18/10/2023

6 min read

Feature

Australia has an energy export balance problem and is hoping green hydrogen will be the solution. But Michael Barnard, Chief Strategist at TFIE Strategy, argues that the country’s green hydrogen ambitions are grossly optimistic.

Australia exports four times as much primary energy as it uses in its domestic economy, according to the latest Australian government figures (2022). Over 7% of GDP used to be fossil fuels, mostly exports. Now it’s 1.8% and falling. That 1.8% is direct contributions of the industry to GDP. Indirect contributions through goods and services that the industry purchases like vehicles and accounting double or triple that number, so it’s still a big number.

There are reasonable concerns for governments when it comes to the transition away from fossil fuels.

Green hydrogen

In Australia, a 2019 hydrogen strategy initiative led by the country’s Chief Scientist Alan Finkel said that the nation would focus on hydrogen for transportation, gas networks, heating, electricity systems and export, along with a smaller group of use cases like green ammonia and green steel. Finkel has subsequently backed off substantially from his support for hydrogen for transportation, realising that fuel cell vehicles were uncompetitive with battery electric ones.

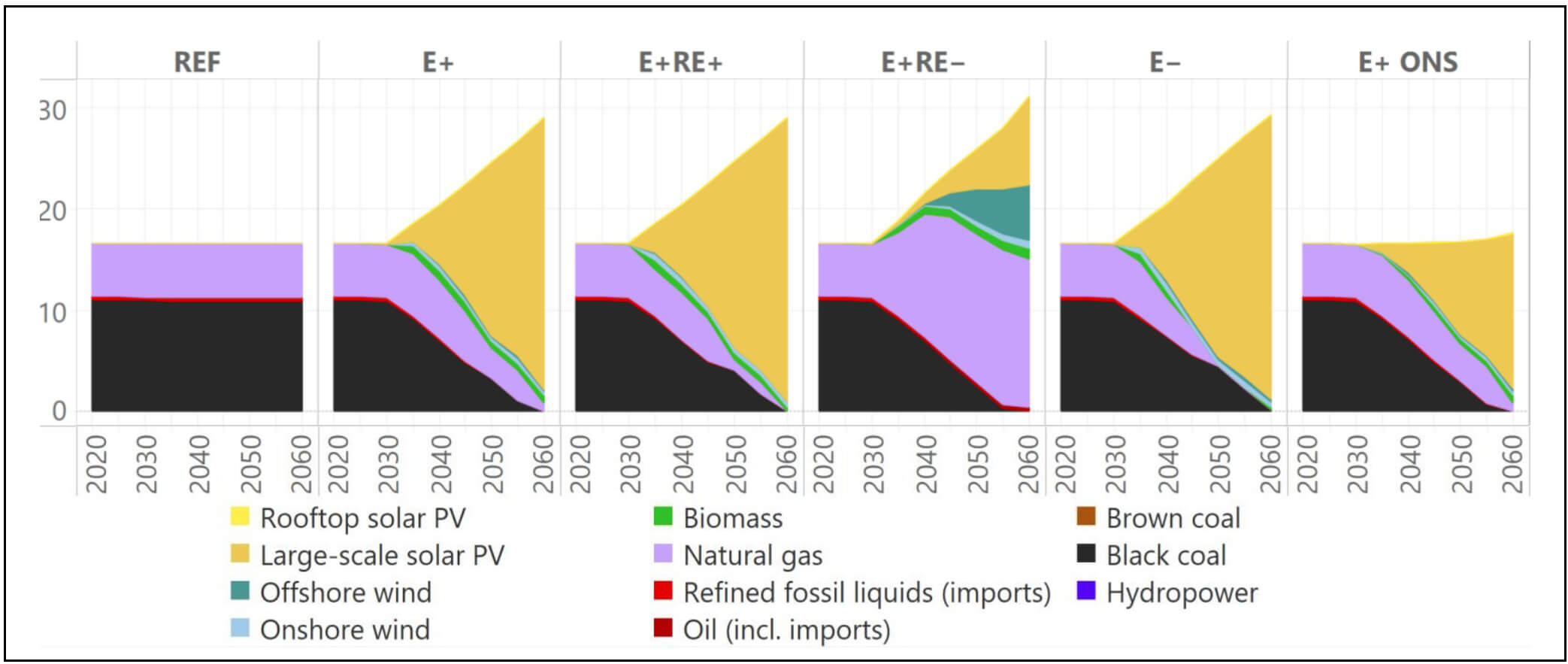

A 2023 Net Zero Australia study leaned heavily on green hydrogen for export, with most scenarios doubling energy exports. (See Fig 1.) The Australian Renewable Energy Association (ARENA) has more modest goals, focusing on green hydrogen for industrial feedstock uses and projecting a much smaller potential export market. It has provided A$236mn ($149mn) in funding for 43 green hydrogen projects and sees the potential for exporting up to three million tonnes of hydrogen a year in 2040.

Fig 1: Australian projected export primary energy, in exajoules/y

Source: Net Zero Australia

Expectations of exporting hydrogen for energy is related to European and Japanese energy import projections, which some consider unlikely. Both are currently major importers of fossil fuels from other geographies.

Shipping hydrogen would be a minimum of five times as expensive per unit of energy as shipping LNG due to the nature of the gas, the requirement for chilling to 20° above absolute zero, losses due to boil off and the lower energy density of liquid hydrogen compared to liquid natural gas. Injecting hydrogen into pipelines would require at minimum three times the operational cost to transport the gas due to greater compression requirements, but German studies have made it clear that current pipelines can only be safe if run at much lower pressures than used for LNG.

Imported hydrogen would be five to 10 times the price of LNG, the most expensive and least used imported energy. No country which went down that route would be able to compete with economies which electrify directly.

Renewables, HVDC (high voltage direct current) interconnects and grid storage are growing rapidly in every country in the world, diminishing the requirement for fuels for electrical generation.

Shipping hydrogen would be a minimum of five times as expensive per unit of energy as shipping LNG due to the nature of the gas, the requirement for chilling to 20° above absolute zero, losses due to boil off, and the lower energy density of liquid hydrogen compared to liquid natural gas.

Hydrogen on the move

For transportation the outlook for hydrogen or synthetic fuels manufactured from it is poor. As Finkel now accepts, light vehicles will mostly be battery electric in the future, and that represents 25% of global oil demand by itself.

China’s Sinopec announced that gasoline demand for the country would peak this year due to the accelerated adoption of electric light vehicles. Gasoline across transportation sectors represents 45% of oil demand.

There are roughly 1.1 million battery electric buses and trucks on China’s roads, and under 10,000 registered fuel cell vehicles. Buses and trucks are dominated by diesel engines, and 29% of oil demand is for diesel fuel.

The Cambridge Centre for Sustainable Road Freight found that hydrogen fuel cell trucks would be 1.5 to two times as expensive as battery electric trucks per European OEMs (original equipment manufacturers), and that green hydrogen fuel for them would be three times as expensive as direct use of electricity, making them uncompetitive.

China’s 72% passenger and freight rail electrification and rising is only exceeded by India’s 85% and target of 100% by 2025. Europe is at 60% rail electrification and rising. The Trans-Siberian Railroad is electrified. Only the US and adjacent countries are not heavily leaning into grid-tied electricity for rail yet.

Battery energy densities that are already commercially available are sufficient for most inland and a considerable amount of short sea shipping. By 2040, batteries in laboratories will be commercialised and allow all inland and two-thirds of short sea shipping to be electric at a much lower operating cost than green hydrogen or derivatives. Some 40% of bulk shipping is dedicated to the transportation of coal, oil and gas across oceans, and shipping fuel demand will decrease with peak fossil fuels.

Hydrogen as a gas or in liquid form has no path to certification for commercial passenger aviation. Battery electric energy densities are already viable for 300 km trips, and with the increases expected, will be viable for 3,000 km flights. Only longer haul flights will require liquid fuels.

Just as today, where millions of tonnes of biofuels are used in aviation and shipping annually, liquid fuels will be dominated by biofuels in the future. Hydrogen will be used in the processing of these fuels, but that will be a relatively small market.

Making hydrogen green

We manufacture about 120mn tonnes of hydrogen annually, almost entirely from natural gas and coal. Each tonne results in eight to 34 tonnes of CO2, not to mention leaking methane and hydrogen, both much more potent greenhouse gases than CO2. Over a billion tonnes of greenhouse gases are emitted due to manufacturing hydrogen every year.

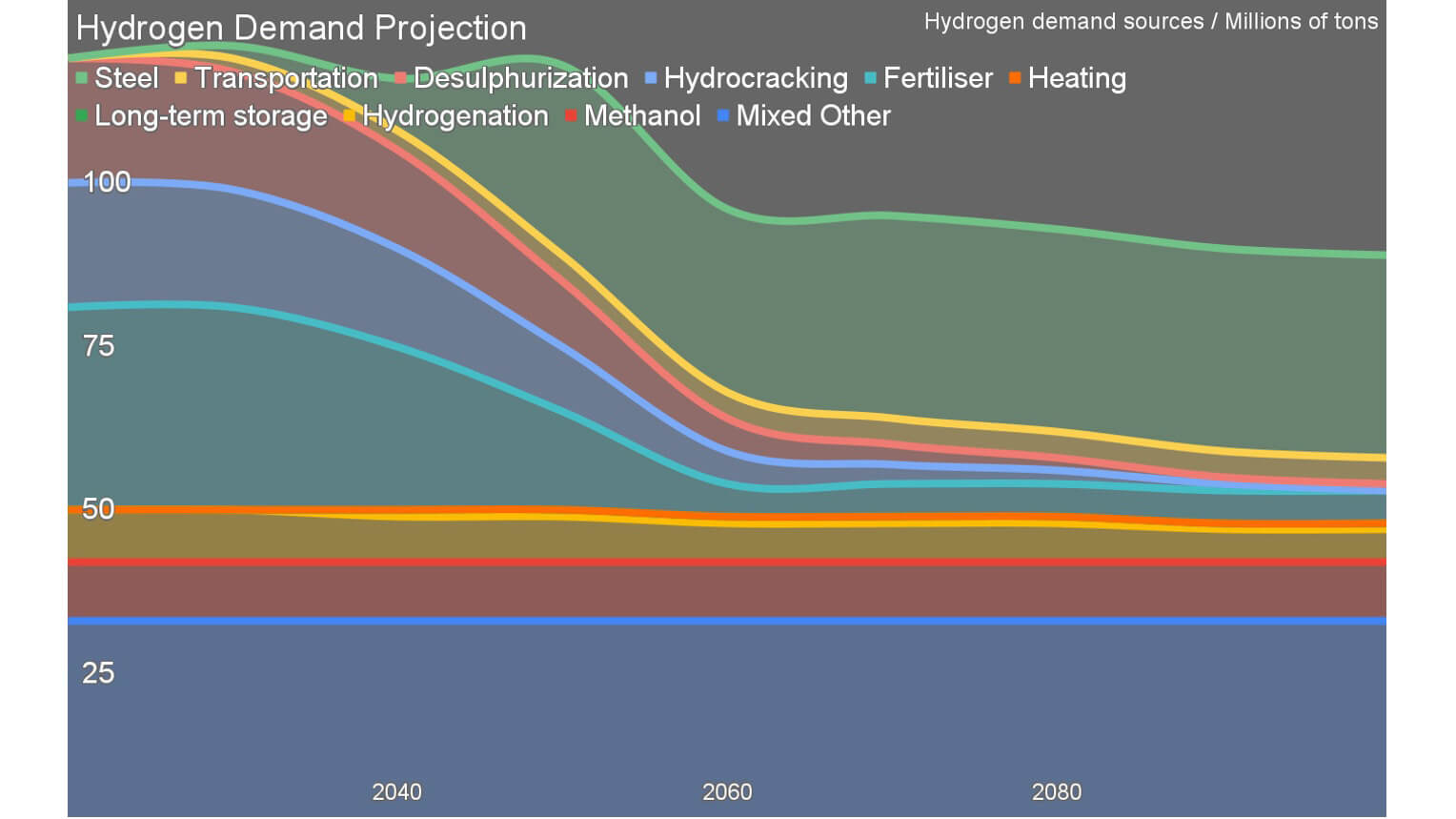

Until the past couple of years, all of the renewable electricity in the world would have been sufficient only to manufacture the 120mn tonnes of hydrogen we use. (See Fig 2.)

Fig 2: Hydrogen demand projection through 2100, in mn tonnes

Source: M Barnard

About 40mn tonnes of hydrogen is used in oil refineries to remove sulphur, water and impurities from crude, and to separate it into lighter and heavier components. As peak oil demand’s impacts move through our global economy, that’s going to diminish rapidly.

The next biggest market is ammonia for fertilisers, about 30mn tonnes. We must remove the carbon from that hydrogen stream as well, but will likely diminish the amount of hydrogen required. Agrigenetics is creating nitrogen-fixing microbes which fix nitrogen from the air at the roots of plants much more efficiently and effectively than natural microbes, explains Pivot Bio. Drone spraying of fertiliser is much more efficient at getting the right amounts of products into the plants.

The only obvious growth area for hydrogen is manufacturing low-carbon steel. The Swedish HYBRIT approach uses about 55 kg of hydrogen per tonne of steel, leading to around 30mn tonnes of new hydrogen demand. Even there, direct use of electricity is proven in processes from both Boston Metals and Fortescue, so hydrogen demand growth is not guaranteed. Australia will use green electricity to process its iron ore into iron and steel to a greater extent in the future and will likely go through green hydrogen pathways for some of that.

Green molecules have an export future for Australia, just not for energy. Ammonia for fertiliser will still be required. Currently it comes from the oil and gas centres of the world. In the future, what isn’t manufactured locally from green electricity and water will be imported from countries with surpluses of land and water like Australia. Methanol manufacturing produces in the range of 500–700mn t/y of greenhouse gases and must be decarbonised as well.

There is potential for Australia to export green methanol and ammonia in the future, in addition to green steel and green aluminium.

Displacing fossil fuels

But these are a tiny fraction of the mass of fossil fuels. Currently, the world extracts, processes, refines and distributes about 18bn t/y of coal, oil and gas. Roughly 11% of all energy use globally is used just for those processes. About 175mn t/y of ammonia and 170mn t/y of methanol are manufactured, and as green variants will be more expensive, there will be downward pressure on demand, not a significant expansion.

Australia’s energy exports will continue to decline, and even more sharply. The 7.1% that became 1.8% will become 0%. European and Japanese expectations of importing green molecules for energy will diminish rapidly as realistic cost projections for the end-to-end manufacturing and distribution value chain become clear, and the requirement for it continues to be eroded by renewables, transmission and storage.

Australia will be exporting energy. It will end up connected to Indonesia, the Philippines and Singapore with HVDC electricity transmission cables, sharing wind and solar energy across thousands of kilometres. But it won’t be doubling its energy exports in the form of green hydrogen or its derivatives.