UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Turbulent year for the retail fuel market – what were the causes?

19/4/2023

9 min read

Feature

Last year, 2022, was a turbulent year for all retail fuel users – due to the Ukraine war, severe weather and supply shortages – the list goes on. The UK retail fuel market was also subject to turbulence. Catherine Cosgrove MCLIP, FEI, Knowledge and Information Officer at the Energy Institute, puts us in the picture.

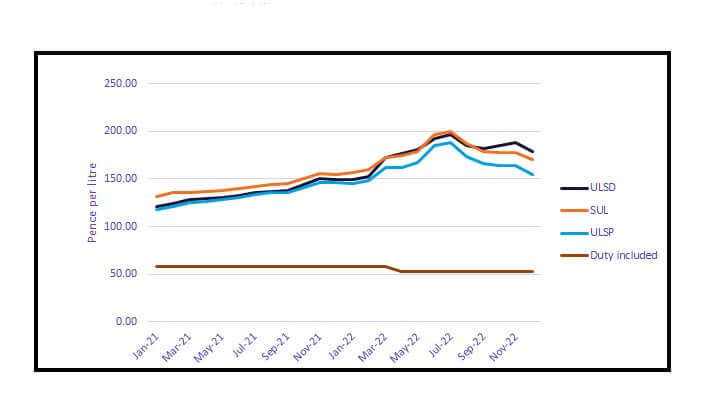

In the UK forecourt retailing sector, 2022 was dominated by ever-rising road fuel prices. Average unleaded ultra-low sulphur petrol (ULSP) prices for January 2022, although slightly down on December 2021, at 145.70 p/l were 23% higher than the average pump price in January 2021. Prices continued to rise in February 2022, and then on 24 February Russia invaded Ukraine.

The effect on the crude oil market was immediate, as was the knock-on effect on the price of refined oil products. Brent crude reached $139/b on 7 March 2022, its highest level for 14 years. By April, the average price of a litre of ULSP had jumped to 161.63 pence. In the March 2022 Spring Statement, the UK Chancellor of the Exchequer reduced the duty on all road fuels by 5 p/l, from 58 p/l to 53 p/l, although VAT remained at 20%.

But pump prices continued to rise, reaching an all-time average high of 188.41 p/l for ULSP in July 2022. The Spring Statement on 15 March 2023 has seen Chancellor Jeremy Hunt retain the 5 p/l drop in duty rate for another year, despite the average price of petrol dropping to 148.65 p/l for February 2023.

After the reduction of duty from 23 March 2022, the RAC motoring organisation constantly accused fuel retailers of not passing on the benefit to their customers. On 11 June 2022, the then-Secretary of State for Business, Energy and Industrial Strategy requested that the Competition and Markets Authority (CMA) carry out an urgent review of the fuel market, the Road fuel market study. The CMA’s initial report in July 2022 showed that the 5 p/l cut in duty had been passed on, the average margins made by retailers had remained about the same over the previous year, and the market remained competitive.

The CMA found that the rise in price was due to the rising cost of crude oil entering refineries; limited refining capacity due to mothballing of capacity during the COVID-19 pandemic; the wholesale price of products leaving the refineries; and the drop of value of sterling against the dollar. The CMA issued an initial updated report on 6 December 2022, asking for responses by 6 January 2023.

Protests against the rise in the price of fuel continued through July 2022. FairFuel UK’s campaign to get the CMA to introduce PumpWatch, a proposed independent pump-pricing monitoring body, was backed by some MPs. The M5 and A38 saw slow moving convoys set up to protest the high fuel prices.

And, despite the CMA’s initial findings, the RAC continued to accuse the retailers, especially the supermarkets, of not reducing prices at the pumps as the wholesale price of petrol was also falling. The Petrol Retailers Association (PRA) continued to refute the RAC’s claims, pointing out that forecourt businesses were subject to the same rises in costs as the rest of the UK economy.

In June 2022, the RAC was calling for further price cuts as fuel prices reached even higher levels. By August, it was still accusing the UK government of not helping motorists as much with temporary tax cuts as other European countries – the UK ranked 12th out of 13 countries, with only Luxembourg doing worse.

Fig 1: Average petrol prices in the UK, 2021–2022

Fig 1: Average petrol prices in the UK, 2021–2022

Source: Experian Catalist

The rising prices also resulted in record levels of forecourt crime – mostly as motorists drove off without paying.

For opposite reasons, August 2022 saw the environmental protest group, Just Stop Oil, smashing up pumps and blocking the entrance to forecourts in London. They also targeted fuel oil depots and an oil refinery.

Despite all the problems, Christie & Co reported receiving, on average, five offers for every petrol filling station it sold in 2022.

UK petrol stations

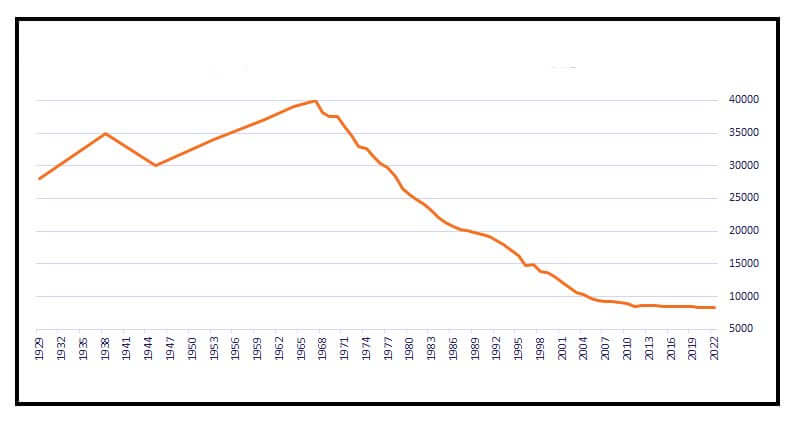

At the end of 2021 there were 8,381 service stations in the UK. By the end of 2022 there were 8,364 – 17 fewer. There were three less in England, 10 less in Wales and five less in Northern Ireland; but one extra in Scotland. (The Isle of Wight, not included in the totals, ended 2022 with 16 – one less forecourt than in 2021.)

Fig 2: Total number of UK petrol stations, 1929–2022

Fig 2: Total number of UK petrol stations, 1929–2022

Source: Experian Catalist

Esso, BP and Shell were still the major brands, but BP, down by 23 to 1,195 forecourts, was now in second place to Esso’s 1,238. Esso had gone up by 24; while in third place, Shell had increased its total by 11 sites to 1,146. Texaco was still in fourth place, with 703; and Tesco in fifth position, with 512. None of the other brands had more than 500 forecourt each.

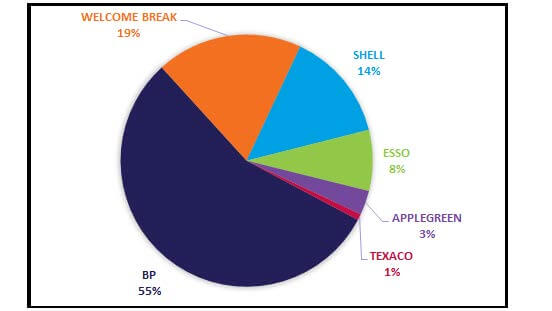

BP still has 71 motorway sites – 55% of the total, which remains at 128. Shell passed four of its motorway sites to Welcome Break.

Some 1,633 forecourts belong to supermarkets.

In September 2022, the Co-op agreed to sell its 129-site forecourt business to Asda but, almost immediately after, it was reported that the CMA might force Asda to sell 10% of the sites due to competition rules.

Fig 3: UK motorway sites – total number of outlets in 2022

Source: Experian Catalist

UK fuel sales

By the end of 2022 the total volume of road fuel sold in the UK had almost returned to pre-pandemic levels, despite its rising cost. About 11.8mn tonnes of petrol was sold, over 46% through supermarkets; and 24mn tonnes of diesel, 26.7% through supermarkets – although supermarkets only account for 20% of the total number of forecourts.

Electric and other vehicles

Overall, the number of registered vehicles on UK roads, of all fuel types, increased in 2022 by 2.69% to 40.8 million. Before the pandemic, annual growth had been over 3%/y. But during the 2020 and 2021 COVID years this figure dropped to just over 1%.

However, manufacturing of new cars in the UK fell during 2022, mainly due to a shortage of components. According to the Society of Motor Manufacturers and Traders (SMMT), new car registrations totalled 1,614,063 in 2022 – down 2% on 2021. This included 101,414 hybrid cars – down 11.5%; and 267,203 fully electric cars – up 40.1%.

The fall in availability of new cars had a knock-on effect on the second-hand car market as sellers held on to their old cars for longer.

With the increase of petrol and diesel prices at the start of 2022, had come an increased interest in buying electric vehicles (EVs), although sales of EVs were still well below that of internal combustion engine (ICE) ones.

Potential EV owners were no longer put off by ‘range’ fear. EVs had proven they could travel long distances between charges. In April 2022, Mercedes-Benz demonstrated a 620-mile range. More buyers and manufacturers turned to EVs.

For example, Fiat decided not to sell any more non-electric cars in the UK from 1 July 2022, although hybrids would be available. In August, Royal Mail reported using over 3,000 electric vans across its delivery and collection fleet.

According to the SMMT, new car registrations totalled 1,614,063 in 2022 – down 2% on 2021. This included 101,414 hybrid cars – down 11.5%, and 267,203 fully electric cars – up 40.1%.

But not all reports about EVs were positive. In October, a pro-ICE, All Party Parliamentary Group (APPG) called Fair Fuel for UK Motorists and UK Hauliers, and funded by FairFuelUK, the Alliance of British Drivers and Motorcycle Action Group, sanctioned a report from the Centre for Economics and Business Research (CEBR) stating that while the environmental benefits of banning sales of new ICE cars in 2030 will be worth £76bn, the costs will be £400bn.

Furthermore, the fuel crisis hitting the UK pushed the price of electricity up to such high levels that potential EV purchasers started to think again. The UK government didn’t help sales in June 2022 by ending the temporary plug-in grant for purchasing EV cars after successfully kickstarting the UK’s electric car revolution.

It would now concentrate on grants for purchasing other e-vehicles such as taxis, motorcycles, vans and trucks, and expanding the public chargepoint network. In the Autumn Statement of 2022, the Chancellor said that owners of EVs will also have to pay vehicle excise duty from 2025.

The RAC still advocated that EVs were better value than petrol and diesel models, despite the energy price cap increases in 2022.

Drivers in London’s Ultra-Low Emission Zone (ULEZ), which expanded at the end of 2021, have the added incentive to change to an EV rather than pay the daily £12.50 fee charged to non-compliant vehicles.

Charge points

Distance anxiety may no longer be a factor for people thinking of buying EVs, but the lack of availability of sufficient public charge points is. On 25 March 2022 the UK government published its Electric Vehicle Infrastructure Strategy. This set out its vision that an EV charging infrastructure would be in place by 2030, when no new petrol and diesel vehicles would be sold in the UK.

In its vision, all new cars and vans will be fully zero emission at the tailpipe by 2035. A government-backed taskforce reported in April that about half a million chargepoints would be needed by 2035, but only 30,000 were in place. It is not just the number of chargepoints that would be important, but also their location and reliability.

The UK government replaced its Electric Vehicle Homecharge Scheme (EVHS) on 1 April 2022 with an EV chargepoint grant which provides ‘funding of up to 75% towards the cost of installing EV smart chargepoints at domestic properties across the UK’. In a report published in August 2022, the Electrifying EV dealership found that: ‘Charging an average EV at home cost nearly £208 a year, compared to more than £1,450 for public charging.’

Publicly accessible charge points are available in a variety of locations.

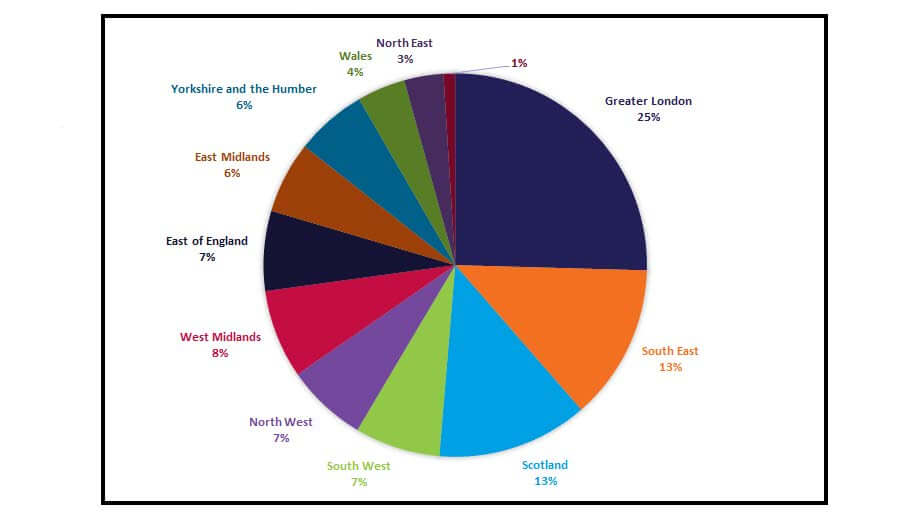

Information from Zap-Map shows the number of public charging points in the UK increased by 31% in 2021 compared to 2020, but in 2022 the increase dropped to 28% over 2021. By the end of 2022, Zap-Map reported there were 61,137 connectors available in the UK.

There is a difference of opinion in the retail sector about the advisability of providing charging points at fuel retailing forecourts or converting them to charging points only.

Fig 4: EV charging connectors across UK

Fig 4: EV charging connectors across UK

Source: Zap-Map

Shell opened its first UK charging hub in Fulham in December 2021. In June 2022 the company said it was extending and increasing its target for installing EV chargers to 100,000 by 2030. It will also install 500,000 chargers in private locations.

In March 2023, BP reported that it runs the UK’s largest public charging network, BP Pulse, with over 7,000 EV charging points across the country. BP will also install chargers in private homes.

By April 2022 the Tesco supermarket chain had placed free to charge EV chargers at 500 locations. But by November it had decided to start charging for use at all its stores.

The future

The proportion of EVs compared with fossil fuel vehicles will continue to grow despite all the challenges, but forecourts selling petrol and diesel will still need to exist for many years to come.

Note: Charging point figures were supplied by Zap-Map. Its website also has a map of every EV charging point in the UK. Fuel retail statistics were supplied by ExperianCatalist; data available here.

EI Road Fuels Collection

The data highlighted here forms part of the Energy Institute’s Road Fuels Collection, where you can find not only UK fuel retail marketing statistics published since 1971, but also additional information covering the road fuels sector, from training courses to technical guidance.