UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Gas flaring flagged at International Energy Week as a major opportunity to combat climate change

8/3/2023

6 min read

Comment

International Energy Week 2023 brought together representatives from across the energy sector and around the world to seek solutions to the challenges they face. The significant though largely preventable problem of venting, flaring and leaking methane was raised throughout the three-day conference. Here, Mark Davis, CEO of Capterio*, a gas flaring software supplier, looks at some of the different perspectives on solving this burning issue.

The discussions at International Energy Week focused on new energies such as wind, solar, batteries, hydrogen and e-fuels, plus electricity grids and energy efficiency. However, one area that was highlighted as a quick win for decarbonisation was the existing operations of the oil and gas industry.

Industry leaders who attended the conference identified gas flaring as the biggest opportunity for reducing supply chain emissions from venting, flaring, and leaking gas. Bjørn Otto Sverdrup, Chair of the Oil and Gas Climate Initiative (OGCI), opened the conversation by stating that ‘flaring and methane is a 3 gigatonne problem’ for oil and gas, and emphasised that ‘it’s up to us to solve it – no one else is going to step in’. At Capterio, we think the opportunity is actually even bigger. We use a 20-year ‘global warming potential’ of methane (since it feels more relevant, given the urgency of the climate crisis), not a 100-year (as is commonly used in the industry), as shown in Fig 1.

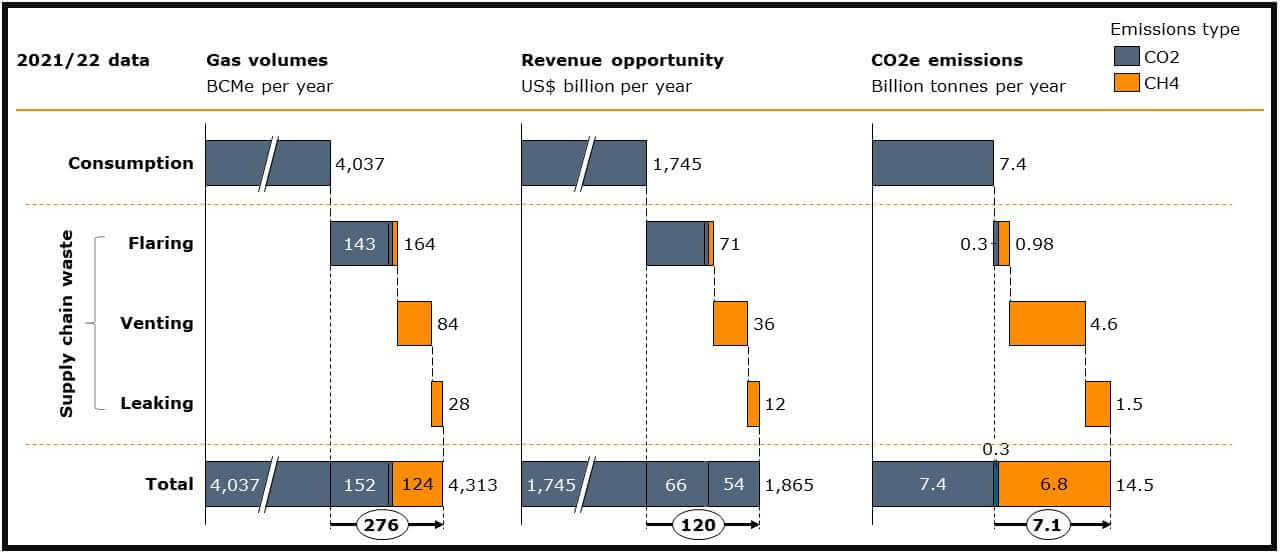

Some of the key numbers around flaring, venting and leaking gas from the oil and gas supply chain, the fixing of which could bring 7% more end-use gas to the market and halve the total Scope 1–3 emissions

Some of the key numbers around flaring, venting and leaking gas from the oil and gas supply chain, the fixing of which could bring 7% more end-use gas to the market and halve the total Scope 1–3 emissions

Note: Capterio account for an average combustion efficiency of flares of 92% and use a ‘global warming potential’ of methane of 82.5 times that of CO2, over a 20-year basis. We assume flares have 10 barrels of liquids per mn cf. Revenue opportunity illustrated at today’s European gas price of $12/mn Btu (€40/MWh) and $80 for liquids.

Source: BP Statistical Review of World Energy (2022), World Bank (2022), IEA Methane Tracker (2023), IPCC (2022), Capterio estimates

Fig 1 puts the wasted gas (from flaring, venting and leaking) in context of the end-used consumption. When methane slip and entrained liquids are included, flaring amounts to 164bn cm of gas and a potential revenue opportunity of $71bn/y. In CO2-equivalent terms this is almost 1bn tonnes.

When venting and leaking gas is included, the total opportunity rises to 276bn cm of gas, $120bn and 7.1bn CO2e tonnes. By fixing flaring, venting and leaking, an additional 7% of end-use gas could be brought to the market (equivalent to 1.7 times the consumption of Africa), and total Scope 1–3 emissions from the oil and gas supply chain could be halved.

Globally, around 276bn m of gas is currently flared, vented and leaked per year (that’s 1.7 times what Europe imported from Russia in 2021), leading to a revenue opportunity of up to $120bn at today’s European prices (around $40/MWh), and a potential saving of up to 7.1bn CO2e tonnes of greenhouse gases. That’s the equivalent of the yearly emissions from 1.5bn US passenger vehicles.

Whilst flaring, venting and leaking varies widely by country, a surprising finding highlighted at the conference last week by industry analyst Robert West (informed by Capterio data) is that ‘there are some barrels for which the Scope 1 emissions are greater than the Scope 3 emissions’, which is, he says, ‘insane’.

At a time when the world urgently needs more gas, and in a market that Namit Sharma, Managing Partner for McKinsey’s Oil & Gas practice says has no spare capacity, it’s imperative that we waste molecules no more. (Incidentally, we would differ with Namit, there is an untapped supply source that is already ‘on production’ today – this wasted gas – although of course it does need some investment.)

A problem with a ready solution

Yet, as the International Energy Agency (IEA) said last week in its Global Methane Tracker, the overwhelming majority of this volume can be fixed using proven technology today whilst also making money (having negative marginal abatement cost). The remainder can be solved at a cost of less than $15/t.

The good news is that many actors are already leaning in. It’s very encouraging to see the progressive leadership of the OGCI and its members, under the leadership of Bjørn Otto Sverdrup. On stage, Sophie Depraz, Deputy Executive Director at trade association Ipieca, outlined its work with members to reduce flaring, together with partners from the World Bank’s Global Gas Flaring Reduction programme the Methane Guiding Principles (of which the Energy Institute is a supporting organisation), the Oil and Gas Methane Partnership (OGMP) and more.

Equally, Shell’s Hugues Bourgogne, Executive Vice President for Safety, Environment & Asset Management, outlined his organisation’s progress too, highlighting how routine flaring was 13% in 2021 (down from 60% in 2010) and how it is on track for zero routine flaring by 2025 (for its operated assets, that is). Bourgogne went on to outline the critical importance of emission detection, quantification and reporting. The importance of accelerated progress was also highlighted by Mark Thomas, CEO of Bahrain’s Nogaholding group, and Alasdair Mackenzie, Director of Strategy, Planning & Business Development at Seplat Energy.

And as Jean-Francois Gauthier, Vice President for Measurements and Strategic Initiatives at GHGSat, put it: ‘The world is increasingly able to see precisely what the emissions are, where, and from whom,’ going on to say: ‘There is nowhere to hide and should be no excuses’ for lack of action.

‘Non-operated’ assets and NOCs

The elephant in the room is, however, not the flaring from the leading players (many of which are already making good progress – at least for their operated assets), but the flaring associated with ‘non-operated’ assets and those run by national oil companies (NOCs).

To make real and dramatic change we need to work together with our state-backed groups to help them to deliver this important agenda. We also need big-picture, integrative, collaborative and creative ‘system’ thinking, coupled with innovative business models and commercial contracting.

The elephant in the room is, however, not the flaring from the leading players (many of which are already making good progress – at least for their operated assets), but the flaring associated with ‘non-operated’ assets and those run by national oil companies.

The prize is large and compelling, and the time for standing by is over, as the upside for NOCs is clear – more revenue, more jobs, more gas for domestic consumption, more gas for export, better investment climate, better air quality and lower carbon emissions.

And as consumers become increasingly aware of the supply chain emissions embedded in the products they buy, there is a key role for product certification. As Saima Chaudry Yarrow, Head of LNG at MiQ, said: ‘We need to rapidly scale the voluntary market [to reduce emissions from within our energy supply chains] as we can’t wait for regulation as that will take time, and we don’t have time.’

Key to delivering here is for state-backed entities in particular to:

- Fully appreciate the size of the economic upside (using a data-led approach, for example including Capterio’s FlareIntel platform).

- Improve the effectiveness of regulation.

- Identify the best technologies.

- Bring the right resources (of capital and capability) to bear.

Capterio’s case studies from Algeria, Egypt, the US and Iraq highlight how gas-to-pipe and gas-to-power projects can be particularly attractive for reducing emissions, creating value and accelerating the energy transition.

The good news

It was super encouraging to see the keen interest from International Energy Week delegates from a wide range of players on this critical topic. Notable in the conversations were keen interest from operators in several countries in West and North Africa, plus also a growing recognition from investors and financiers.

The good news is that ‘there is a wall of cash’ waiting to be deployed, but as Seb Henbest, Group Head of Climate Transition at HSBC, noted, ‘capital has choices’, and, by implication, those companies that are more differentiated and on a Paris-compliant pathway are likely to be more investable and see superior returns.

The Energy Institute’s CEO Nick Wayth CEng FEI FIMechE said in his closing remarks: ‘It’s clear that flaring and methane reduction is a clear and urgent global problem.’

We agree. It stands to reason that we must pull together to drive this change. Perhaps we can all learn how to drive change from Bernard Shaw, perhaps, just perhaps, by being a little less ‘reasonable’? – ‘The reasonable man adapts himself to the world: the unreasonable one persists in trying to adapt the world to himself. Therefore, all progress depends on the unreasonable man.’

Watch this space.

*The views and opinions expressed in this article are strictly those of the author only and are not necessarily given or endorsed by or on behalf of the Energy Institute.