UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Decarbonisation challenges in the upstream sector

23/11/2022

6 min read

Feature

Pressure is building on oil and gas companies operating upstream to decarbonise. Here, Jessica Brewer, Principal Analyst Upstream at Wood Mackenzie, examines the policies, initiatives and challenges facing oil and gas companies as the sector addresses the path towards net zero.

As the energy transition unfolds, upstream companies are coming under increasing pressure to decarbonise. There are strategic advantages to producing less carbon-intensive hydrocarbons. Indeed, some consumers looking for cleaner, more sustainable end-products may even consider paying a premium.

Lower emissions operations not only offer environmental gains, but actually boost value, with greater production efficiency, reduced leakage, and the capture (and monetisation) of fugitive flare gas and methane.

Net zero targets for Scope 1 (direct) greenhouse gas (GHG) emissions and Scope 2 (indirect from electricity supply to operations) emissions are now an industry standard. However, it’s a very different story for Scope 3 (indirect value chain) emissions. More and more companies are announcing bold commitments via carbon reduction, net zero and/or Scope 3 targets, but more action is needed if the sector is to successfully achieve decarbonisation.

Divestment of fossil fuel assets is one way to help meet these goals. But for many assets, especially those in production, this simply passes the problem down the line. Applying decarbonisation solutions can reduce operating emissions where operators do want to retain their portfolio of assets.

Where do upstream emissions come from?

Emissions occur throughout the whole hydrocarbon value chain – from wellhead to end-use. Only 10 large oil and gas companies have so far committed to Scope 3 net zero, which accounts for 80–95% of total carbon emissions in the value chain of a hydrocarbon. The most ambitious oil and gas companies are targeting net zero Scope 3 by 2030, with the majority aiming for 2050.

Nevertheless, there is much still to do on Scopes 1 and 2 at upstream installations, which currently generate around 1.3bn t/y of CO2e (about 3.6% of global emissions). These account for the operational emissions that upstream producers have control over.

Each asset is different, so it will come as no surprise that there are regional variations.

Oceania is heavily influenced by Australian LNG projects. High CO2 projects in Asia drive up venting to over 10% of total emissions, and flaring contributes a third of Africa’s output. See Figs 1 and 2.

Fig 1: Global carbon intensity upstream, by region, average 2022–2031

(Based on underlying asset-by-asset data and models – excludes transportation emissions, as not all oil and gas companies own pipelines and/or tankers)

Source: Wood Mackenzie emissions benchmarking tool

Fig 2: Global upstream emissions by source, average 2022–2031

Fig 2: Global upstream emissions by source, average 2022–2031

(Based on underlying asset-by-asset data and models – excludes transportation emissions, as not all oil and gas companies own pipelines and/or tankers)

Source: Wood Mackenzie emissions benchmarking tool

What are some of the solutions?

Solutions to reduce Scope 1 and 2 carbon emissions range in cost and complexity, from smaller-scale operational efficiency solutions and best practices to transforming power generation.

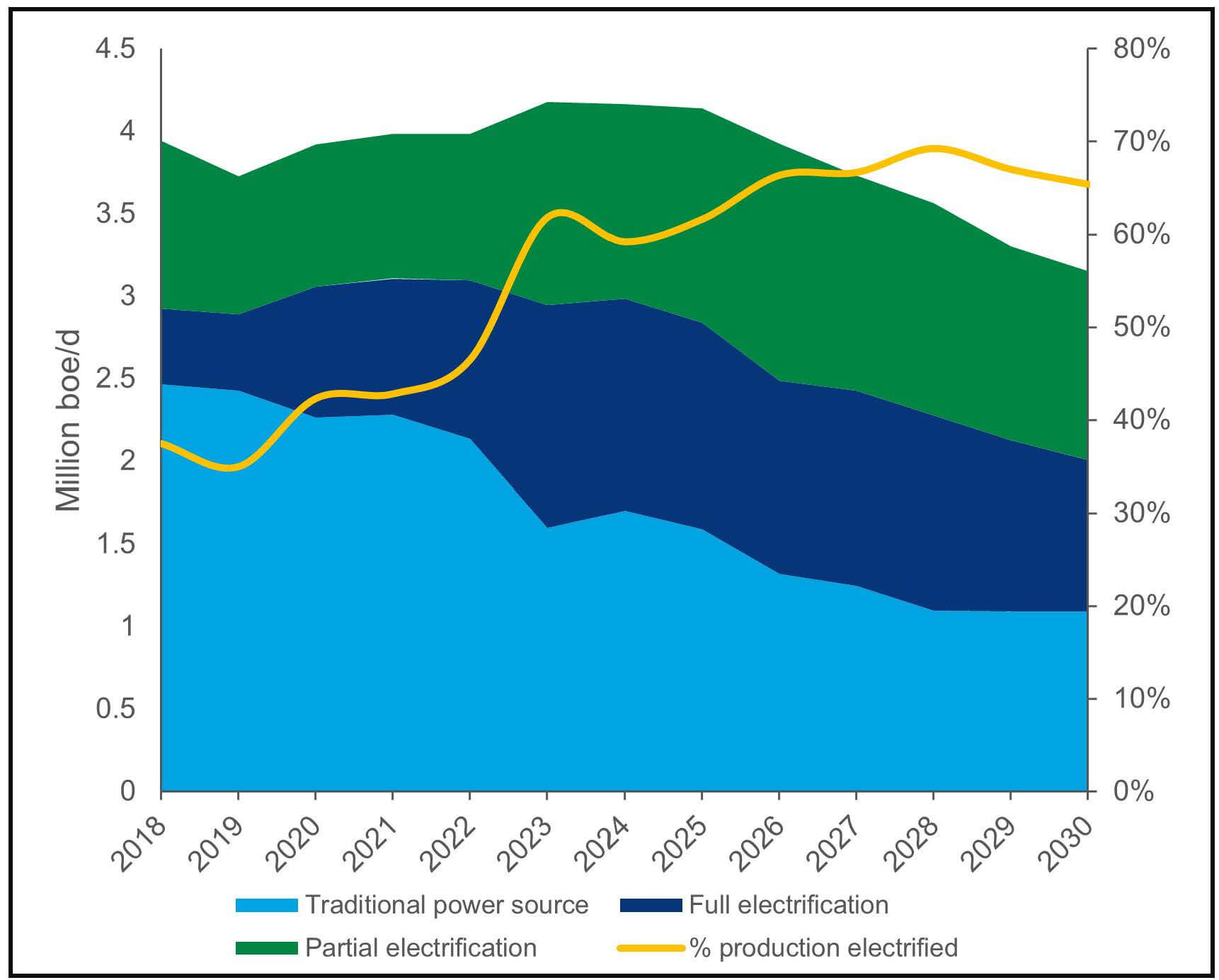

Low carbon power: Around 70% of emissions are produced to power oil and gas operations – production, processing, liquefaction and drilling. The type of fuel used to generate power is a vital factor. Most assets are powered by fossil fuels – using a portion of the produced hydrocarbons. Electrification gives operators the option to move to low carbon power, either directly from renewables or by connecting to the grid where the grid mix is cleaner than the alternative fuel supply.

As well as lower emissions, electrification reduces maintenance, lowers fuel requirements, increases uptime, and frees up more molecules for sale. But there are challenges:

- Intermittency: Renewable power may require back-up generation. If hooking up to the grid, the power mix will determine the scale of emission reduction.

- Retrofitting onstream projects: Not all installations can be electrified. Of those that can, some may only be able to handle partial over full electrification.

- Space and weight restrictions: Electric motors may have a greater footprint and weight than the existing drive mechanisms, limiting options offshore.

- Field maturity: The capital outlay required makes electrification of most late-life assets uneconomic.

Norway is the global leader in low carbon upstream electrification. Its power mix is predominantly hydroelectric (90%+) – a renewable energy source without any corresponding intermittency issues. This, combined with the highest carbon taxes for exploration and production companies globally, has helped advance decarbonisation efforts. By next year, over half of Norway’s production will be either fully or partially electrified. See Fig 3.

Fig 3: North Sea electrification forecast 2018–2030

Source: Wood Mackenzie North Sea electrification tracker

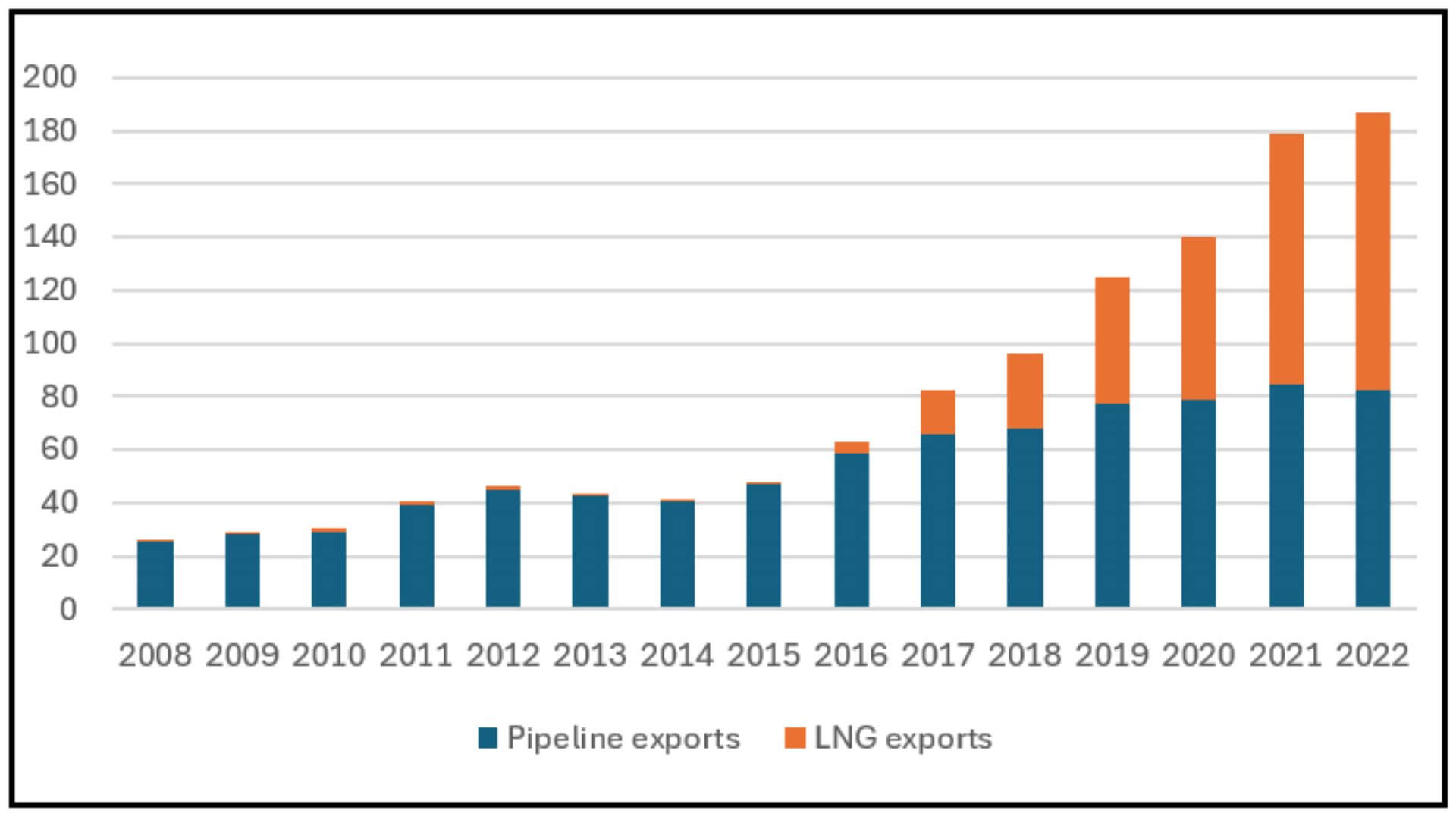

Flaring reduction: Essential flaring is hard to avoid, but many companies are now signed up to the World Bank’s Zero Routine Flaring by 2030 initiative, which targets an end to the practice of routine flaring no later than 2030. However, in some countries, large-scale flaring is a function of the reliance on income from oil exports. Gas is a by-product and is more economic to flare, as building the necessary commercialisation infrastructure can be very expensive.

Where feasible, gas capture projects offer an option for large-scale flarers to limit emissions. Gas capture can provide an additional revenue stream for the companies involved, greater income via taxes for governments and help satisfy unmet power demand, as well as having environmental benefits.

Key considerations:

- Gas markets: Either domestic or export.

Project economics: Resource scale, capital outlay and fiscal terms determine viability.

Number and size of flares: Capturing from multiple sources can be a deterrent for flare-gas collection, even where local markets exist.

Location of point sources: Multiple small-scale emitting point sources with a large dispersion range are more challenging than a single large-scale point source.

Midstream infrastructure: Requirement for gas transport.

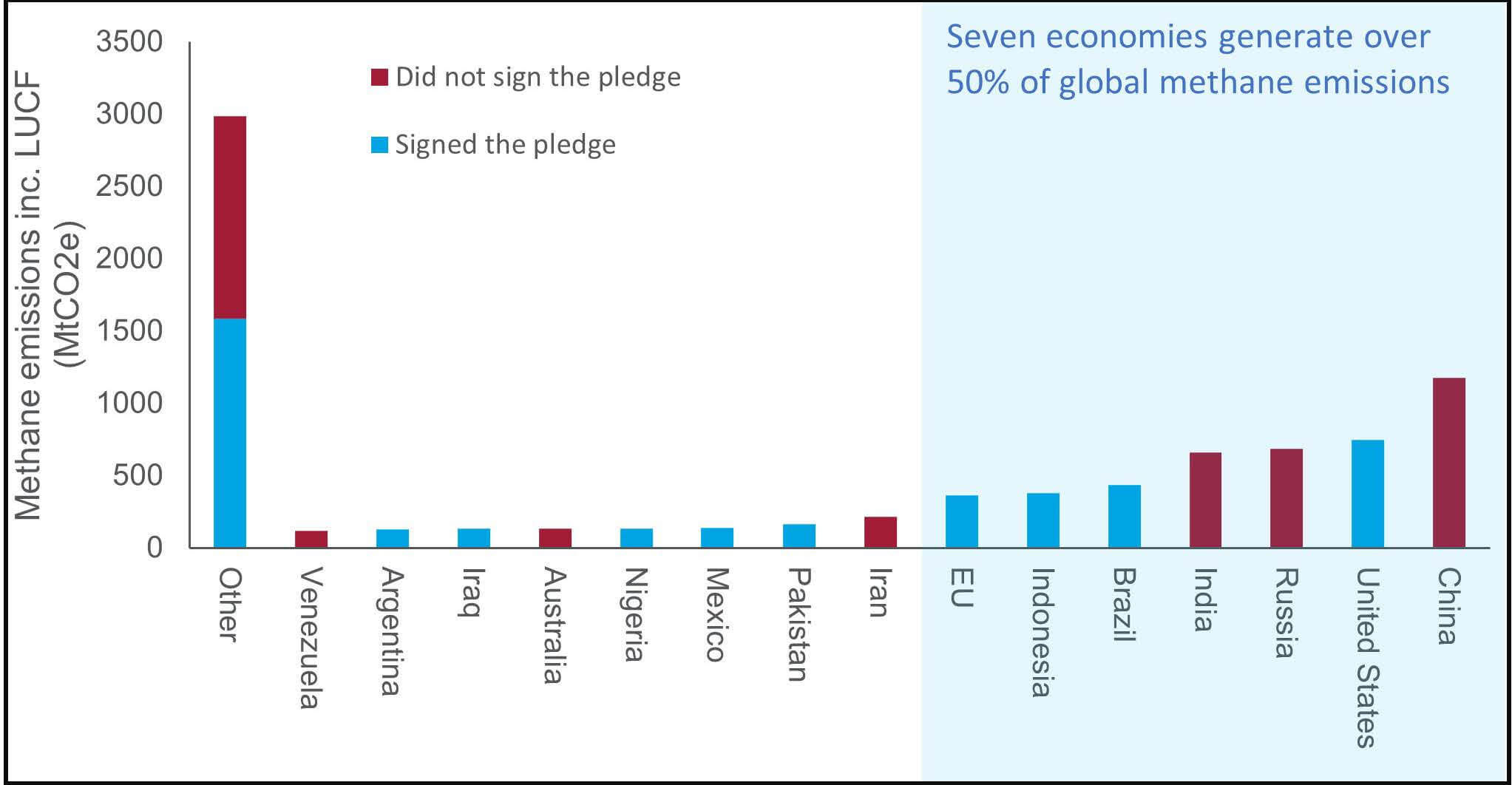

Reducing fugitive (methane) losses: Methane is a molecule that packs a punch. It is 28 times more potent (over a 100-year horizon) than its carbon counterpart according to the Intergovernmental Panel on Climate Change’s (IPCC) 5th Assessment Report (2014).

The oil and gas sector contributes almost 25% of global methane emissions, and as such it has a key role to play. Many companies and governments have already signed up to reduction pledges, including the Global Methane Pledge, which was announced at COP26. The pledge has set the target to cut methane emissions by 30% by 2030. Over 120 parties have signed pledges covering nearly 50% of global methane emissions. Members of the influential Oil and Gas Climate Initiative (OGCI), that operate over one third of global oil and gas production, have pledged net zero methane emissions by 2030. See Fig 4.

Fig 4: Methane emissions including land-use change and forestry (LUCF), in mn tCO2e

Source: Wood Mackenzie

Upstream methane losses are primarily via three sources – equipment leaks (valves, pipes, compressors etc), incomplete flare combustion, and venting. To address these losses, there are three steps to follow:

- Identify, measure, monitor: Methane leaks are often small and difficult to detect. Understanding areas to target helps determine the best solution.

- Flaring and venting reductions: Prevents methane release but the same challenges for reducing these sources apply.

- Replace high bleed devices: Plug/remove the leaks.

Carbon capture and storage (CCS): This approach is useful where CO2 must be stripped from process streams to comply with infrastructure requirements, and limited alternatives to venting exist. CCS is considered to be a frontrunner with multiple operators across the Americas, Europe, Middle East and Asia who are reviewing solutions. Although not widespread, there are existing projects online. The Sleipner oil field enhanced oil recovery project on the Norwegian Continental Shelf has been sequestering CO2 for over two decades.

But it is only in recent years that interest in CCS has started to take off. CCS is still in its infancy, with many challenges to overcome. For example, most countries lack a legal and fiscal legislation framework covering the likes of sequestration, licensing and the ultimate liability for leakage risk. Project economics also need to stack up if CCS is to attract private capital/investment. In most jurisdictions the commercial (and fiscal) frameworks are yet to be finalised.

In addition, uncertainty around costs is a major factor. Costs will need to reduce if CCS is to scale-up capacity. To date, all the early adopters have received some form of government funding.

Decarbonisation – drivers for change

The pace of decarbonisation varies from region to region, and asset to asset. One of the key differentiators is the level of government support. Some 130 countries have made pledges to reach net zero by 2050 to 2070, covering almost 90% of global emissions. However, no major economy is on track to achieve these very challenging goals.

Commitments that have been translated into law only cover around 16% of the total 36 Gt of CO2 emitted in 2021, meaning that pressure to decarbonise will increase significantly as governments work pledges into legislation.

So far, 72 national and sub-national carbon prices and markets are in place, covering around 26% of global carbon emissions (of these, China is around one-third), and another 49 are under consideration. Wood Mackenzie expects significant global expansion of carbon prices, and increased prices aimed at meeting 2050 goals.

Some countries have also been exploring carbon border taxes. The European Union (EU) is due to introduce a carbon border tax in 2023, which will be fully effective by 2027. At that point, importers of certain commodities, including refined products, will need to pay carbon prices aligned with the ones paid by EU producers (which have been over $80/t CO2e for most of 2022).

Most countries’ oil and gas upstream operations are not directly subject to carbon prices yet. Carbon pricing mechanisms typically encompass Scope 1 emissions in specific sectors directly, such as power generation first, followed by some industrial sectors.

Integrated companies can be impacted directly, while independent upstream producers will be indirectly affected by lower demand down the value chain and by carbon prices passing on higher power prices to the grid.

Tackling Scope 1 and 2 emissions is fast becoming the minimum requirement for upstream operators, as they face increasing stakeholder pressure to decarbonise. Even if they do not have any direct value at risk from carbon prices today, due to the location of their operations, they may not be able to attract investment unless they show structured and realistic plans for decarbonising their operations.

For this reason, many companies have taken bold initiatives to reduce Scope 3 emissions, not just Scope 1 and 2. Given the lack of direct control, upstream operators can change their vendors and buyers towards lower carbon value chains, for example, or take a more hands-off approach by buying carbon offsets to compensate for emissions down the value chain.

The most successful strategies will employ a mix of approaches that leverage their existing subsurface and market capabilities and employ them in areas such as CCS. Taking bold, decisive action on decarbonisation is the only way to create sustainable business models that will continue to attract investment.