UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Challenges and opportunities on Canada’s path to net zero transportation

22/6/2022

6 min read

Feature

Canada’s road transport accounted for 21% of the country’s total greenhouse gas (GHG) emissions in 2018, according to its government. Advanced biofuels, low carbon substitutes for petroleum, are becoming an increasingly popular way to reduce emissions. Ian Thomson, President of Advanced Biofuels Canada (ABFC), writes about decarbonising the Canadian transportation sector.

On the basis of population, Canada is a small player in the global energy sector. But behind its modest profile, the country of 38mn has outsized production and export of fossil fuels, agricultural commodities, forest products, minerals and clean electricity.

In order to meet emission-reduction targets and international climate commitments, advanced liquid biofuels will play a key part in Canada’s low carbon transport developments. Liquid biofuels, requiring minimal changes to fuel distribution infrastructure or the transport fleet, can be deployed rapidly to cut greenhouse gas (GHG) emissions.

When paired with a comprehensive suite of policies at the national and sub-national level, and a robust cleantech sector, Canada is well poised to decarbonise its transportation sector and contribute to this goal globally.

Transportation is Canada’s largest emitting sector on an end-use basis (and the second largest emitter on an economic sector basis). When considered against the country’s vast scale, small population and cold climate, this sector has faced particular challenges relative to climate action. But steps are underway to address these.

Canada’s fossil refiners, after lagging behind their US counterparts for the past decade relative to incorporating renewable fuels, have moved quickly in recent years to develop advanced biofuel production capacity.

Biomass refiners

Parkland Corporation has been a Canadian leader, first with 1,725 b/d of co-processing renewable biomass in its Burnaby refinery in British Columbia (BC) and, more recently, an announced 6,500 b/d standalone renewable diesel plant which can also produce sustainable aviation fuel (SAF).

Meanwhile, Braya Renewable Fuels is repurposing an idled refinery in Newfoundland. It will start commercial production of 18,000 b/d of renewable diesel in late 2022, with the capacity to produce SAF.

Other announced projects in Saskatchewan and Alberta will bring Canada’s total advanced biofuel production capacity to over 65,000 b/d, much of it online by mid-decade.

Canada’s innovative cleantech sector has also supported the emergence of globally leading firms such as Iogen, Enerkem, Carbon Engineering and others which are deploying made-in-Canada technologies in commercial-scale production facilities in Europe, the US and Asia.

Agriculture and forestry

Canada’s agriculture sector, already recognised for its sustainability practices including extensive use of conservation tillage, has the capacity to meet existing domestic and international trade obligations while supporting significant new advanced biofuels production.

Meanwhile, the country’s forestry sector leads the world with the largest area of forests where the practices are third-party independently certified, and it has been supplying biomass for renewable power generation in Europe for several decades. More recently, it has turned to the domestic advanced biofuels fuels sector as a new market.

Firms such as Vyterra, Steeper Energy and Arbios Biotech are utilising forest and agriculture residuals to produce biocrude for refinery co-processing and finished renewable hydrocarbon fuels. In addition, renewable synthetic fuel projects being developed will diversify existing reliance on bio-based feedstocks, enabling the long-term expansion of low carbon intensity (CI) liquid fuel production.

Decarbonisation success

Successful provincial decarbonisation policies include a Low Carbon Fuel Standard (LCFS) in BC, which, in its first decade, was responsible for over 12mn tonnes of GHG emissions reduction. A progressively more stringent target has incentivised a 60% reduction in the CI of biofuels supplied to the BC market. BC projects that the LCFS will generate 5mn t/y of reductions by 2030.

Canada’s national electricity generation grid, which is 83% low carbon according to Clean Energy Canada, further enables very low-CI advanced biofuel production. Beyond biofuels, a low-CI grid can support significant GHG reductions from an increasingly electrified light duty transport sector. It will also provide a low-CI foundation for green and blue hydrogen, and synthetic fuels for hard-to-decarbonise sectors such as aviation, rail, long-haul transport and shipping.

The structure of Canada’s federation empowers provinces and territories to set energy policy, while the federal government has power to regulate pollutants such as CO2. Canada’s provinces have used their jurisdiction assertively in the past decade; over 90% of Canadian fuel consumption is covered by some form of provincial renewable or low carbon fuel policy. In 2022, the federal government will finalise a national Clean Fuel Standard, providing a new demand floor underneath that provided by provincial policies.

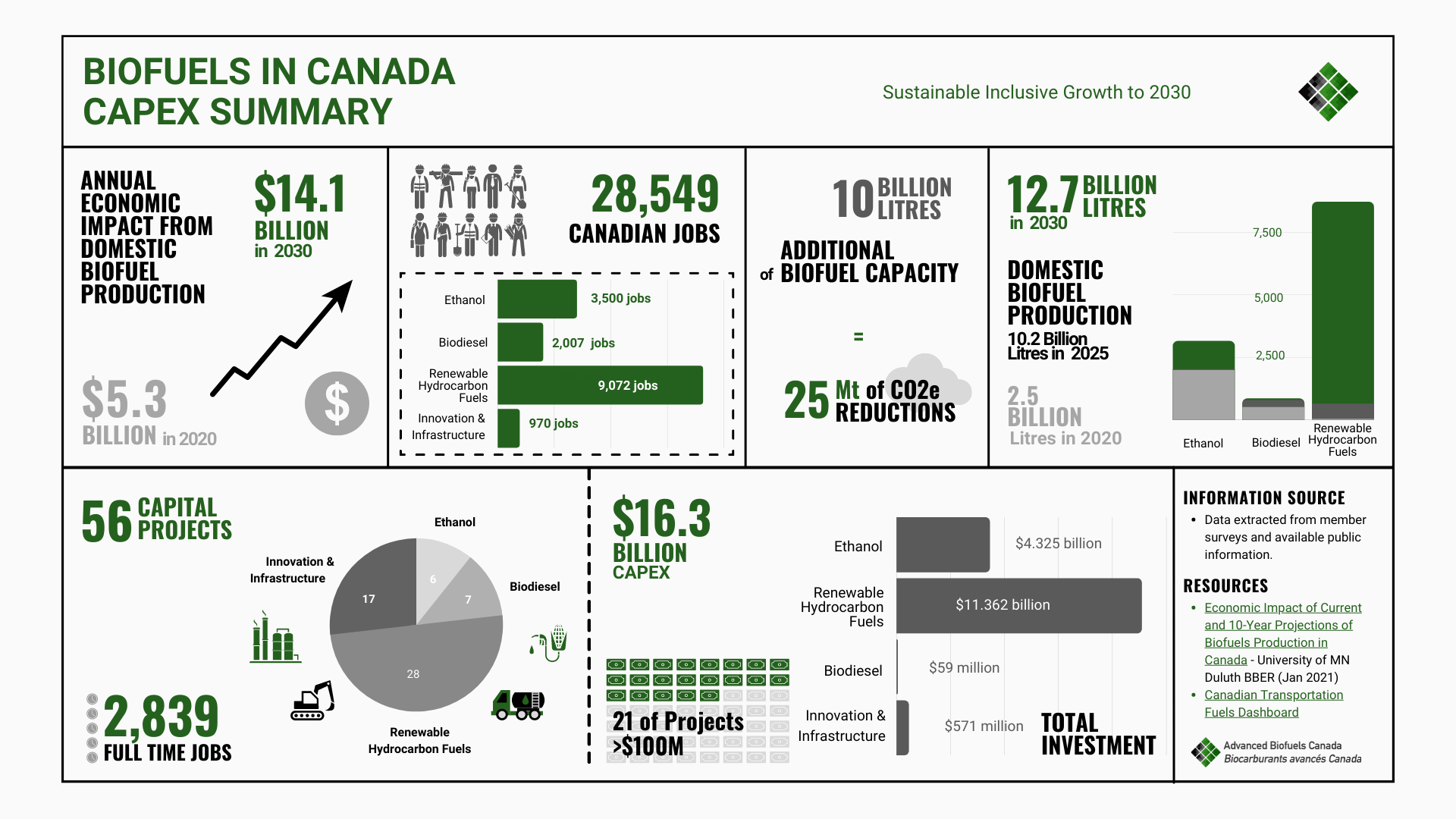

The jobs and economic impact from clean fuel investments planned in Canada over the next decade is assessed in ABFC’s annual capital projects survey. The results of the November 2021 survey of low carbon clean fuel producers, technology developers and industry suppliers is an indicator of the scale and pace at which the sector could grow by 2030. The annual economic impact from domestic biofuel production was calculated to be C$14.1bn ($10.9bn) in 2030, almost tripling the C$$5.3bn ($4.1bn) economic impact in 2020. The new clean fuel projects would increase Canada’s production capacity from 2.5bn litres in 2020, to 10bn litres by 2025 and over 12bn litres by 2030.

The federal government has used its power to regulate pollutants to introduce a carbon price on most fuels used in Canada. In March 2021, the Supreme Court confirmed the federal government’s right to impose a carbon pricing scheme in those provinces which lacked their own. Currently at C$50/t ($38.5/t) the price will rise to C$170/t ($130.1/t) by 2030. With biofuels largely exempted from carbon pricing, they are substantially more competitive vis-à-vis fossil fuels.

Other decarbonisation measures include a federal zero emissions vehicle (ZEV) mandate, with 2026, 2030 and 2035 targets, the last one to be 100% of new car sales. BC and Quebec already have ZEV mandates; but no other provinces are anticipated to regulate ZEV. A national hydrogen strategy will focus on a handful of regional ‘hubs’ to support new production capacity to serve the transport and industrial sectors.

Finally, a proposal to regulate upstream emissions from the oil and gas sector, with a 2050 net zero target, will also contribute to lowering the CI of fossil fuels.

Sustainable growth of Canadian biofuels to 2030

Source: Advanced Biofuels Canada

The future of transport in Canada

Canada has a highly compelling combination of comprehensive, layered policies and regulations to decarbonise the transportation sector. Paired with widely distributed natural resource endowments, the country has not only the wherewithal to transition to a prosperous 2025 net zero economy, but also the potential to emerge as a key supplier of low CI fuels to the world. A relatively stable political environment and strong rule of law help de-risk capital investments, and proximity to the large US energy market and an open border supports global-scale project development with competitive economics.

The decade ahead holds great promise for Canada’s cleantech sector to step into the shoes of the current fossil sector as an engine of prosperity in every region of the country. The sector will also make an indispensable contribution to reducing Canada’s overall GHG emissions, giving the country a shot at meeting its near and long-term climate targets.

Advanced Biofuels Canada (AFBC) is the primary national advocate for advanced biofuels and renewable synthetic fuels. The trade association publishes annually Canada’s most comprehensive opensource dataset on the impact of provincial and federal policy; the most recent edition is the Biofuels in Canada 2021 report. The association also publishes the Canadian transportation fuels dashboard, with provincial and federal data back to 2017, as well as links to fuels regulations.