UPDATED 1 Sept: The EI library in London is temporarily closed to the public, as a precautionary measure in light of the ongoing COVID-19 situation. The Knowledge Service will still be answering email queries via email , or via live chats during working hours (09:15-17:00 GMT). Our e-library is always open for members here: eLibrary , for full-text access to over 200 e-books and millions of articles. Thank you for your patience.

New Energy World™

New Energy World™ embraces the whole energy industry as it connects and converges to address the decarbonisation challenge. It covers progress being made across the industry, from the dynamics under way to reduce emissions in oil and gas, through improvements to the efficiency of energy conversion and use, to cutting-edge initiatives in renewable and low-carbon technologies.

Petrol, diesel and electric vehicles – UK trends

30/3/2022

6 min read

Feature

The Energy Institute’s Knowledge Service (EIKS) team has gathered a wealth of UK vehicle fuel forecourt data and other information relevant to the fuel retailing sector, as part of the latest Retail Marketing Survey (RMS). Here, Gemma Fox reports on the trends and drivers.

Last year, 2021, saw the UK gradually emerge from lockdowns and the easing of both domestic and international travel restrictions that had been put in place to slow the spread of COVID-19. At the same time, the UK took presidency of COP26, with pledges and commitments made to shift away from fossil fuel usage to reduce global CO2 emissions and to limit global temperature rise to 1.5°C.

Meanwhile, the beginning of 2022 has been defined by Russia’s invasion of Ukraine. The impacts of the pandemic, Russia’s invasion and the societal shift towards green energy can be seen in the latest data from the Energy Institute (EI)’s Retail Marketing Survey (RMS) which reflects soaring fuel prices as demand increased, but continued and accelerated growth in electric vehicle (EV) registration and infrastructure.

Fuel prices and sales

In 2021, UK fuel prices rapidly increased month-on-month, with the average monthly price of unleaded petrol rising from a low of 118 pence per litre (p/l) in January to a high of 147 p/l in November. The price of diesel followed the same trend, rising from a monthly average of 121 p/l in January to 150 p/l in November. The increase in fuel prices has continued into 2022 with petrol and diesel prices reaching record highs (as of 20 March the price of petrol and diesel had hit the all-time high of 167 p/l and 170 p/l, respectively).

The root cause of the rising prices is the COVID-19 pandemic. As travel restrictions have eased, globally fuel demand is stretching supply and raising international fossil fuel prices. In the UK, concern regarding fuel supply chain issues, largely related to a shortage of heavy goods vehicle (HGV) drivers, caused ‘panic buying’ of fuel in September 2021. This caused serious disruption to the supply of fuel for a few weeks, with many forecourts across the UK running out of fuel. Supply picked up in October and was accompanied by increases in fuel prices accelerating.

In addition, global supply is being affected as major oil companies continue to pull investment out of Russia following the invasion of Ukraine. Consequently, fuel prices in the UK are set to continue to rise.

During 2021, fuel duty remained constant at 57.95 p/l, and VAT at 20%, unchanged since 2011, despite calls from bodies, such as the RAC and HM’s Official Opposition, for either or both to be cut. However, to help ease the impacts of the rising cost of fuel, Chancellor Rishi Sunak announced in the Spring Statement 2022 that, from 23 March, fuel duty rates will be cut by 5 p/l for the next 12 months.

Although the removal of travel restrictions has resulted in a 7% increase in fuel sales from 2020 levels, total fuel sales in 2021 of 32.8mn litres are still down on pre-pandemic sales of 37.8mn and 37.5mn litres in 2018 and 2019, respectively. This may be a result of the significant increase in fuel prices but also of the shift taking place from internal combustion engine (ICE) vehicles to EVs.

Forecourt numbers

The number of fuel forecourts remained relatively unchanged during 2021. According to data from Experian Catalist, at the end of the year there were 8,381 fuel forecourts in the UK – a reduction of three on 2020 numbers. This total represents the lowest number of fuel retail outlets operating in the UK since records began.

BP, Esso, and Shell still had the highest number of branded fuel outlets, with 43% of the total UK forecourts between them. While the five main supermarkets (and 21 other small outlets) own just over 19% of the total UK fuel forecourts, they accounted for over 34% of the total road fuel purchased.

Although the removal of travel restrictions has resulted in a 7% increase in fuel sales from 2020 levels, total fuel sales in 2021 of 32.8mn litres are still down on pre-pandemic sales of 37.8mn and 37.5mn litres in 2018 and 2019, respectively.

As the number of EVs on UK roads continues to increase it is likely we will see charging points becoming a feature of many UK forecourts. January 2022 saw Shell open its first converted forecourt that now contains solely charging points instead of petrol pumps. In March 2021 it was reported that the independent forecourt operator, Motor Fuel Group, had committed to spend £400mn to install thousands of charging points across the 918 forecourts it operates for various brands, including Esso, BP, Shell, Murco, Texaco and Jet.

Vehicle registrations

The type of vehicles registered on UK roads during 2021 may reflect an increase in society’s consideration for climate change and the desire amongst UK consumers to reduce their carbon footprint. Figures from The Society of Motor Manufacturers and Traders (SMMT) show the number of EVs (including hybrid vehicles) registered in the UK rose by 61% from 465,331 in 2020 to 749,305 in 2021. For purely battery EVs, this figure rose by 75% from 108,205 in 2020 to 190,727 in 2021.

The most popular plug-in EV models in the UK in 2021 by number of registrations were the Tesla Model 3, Kia e-Niro and Volkswagen ID.3, followed closely by The Nissan Leaf, the world’s first mass-market EV. EVs are slowly becoming more cost-competitive with petrol and diesel cars but, to help encourage uptake, the UK government offers a plug-in grant scheme. This currently provides grants of up to £1,500 for those buying an EV costing less than £32,000.

During the same period, registrations of diesel vehicles fell by over 48% and petrol vehicles by nearly 16%. Despite the rising trend in EV registration taking place, the registration of ICE vehicles fuelled by petrol or diesel still outnumbered EVs by 20%, and EVs only make up around 4% of the total number of licenced vehicles on UK roads.

EV charging points

Figures from Zap-Map, the UK's EV charging point app, show the growth in EV registrations has been accompanied by a 32% increase in the number of EV charging points across the UK, from 36,547 in 2020 to 48,056 in 2021, with 11,623 of those being rapid chargers (43 kW+). The major service station companies are playing their part in developing these charging connectors. By February 2022, Shell had 10,000 public charge points, and BP had over 7,000 BP Pulse points across the UK.

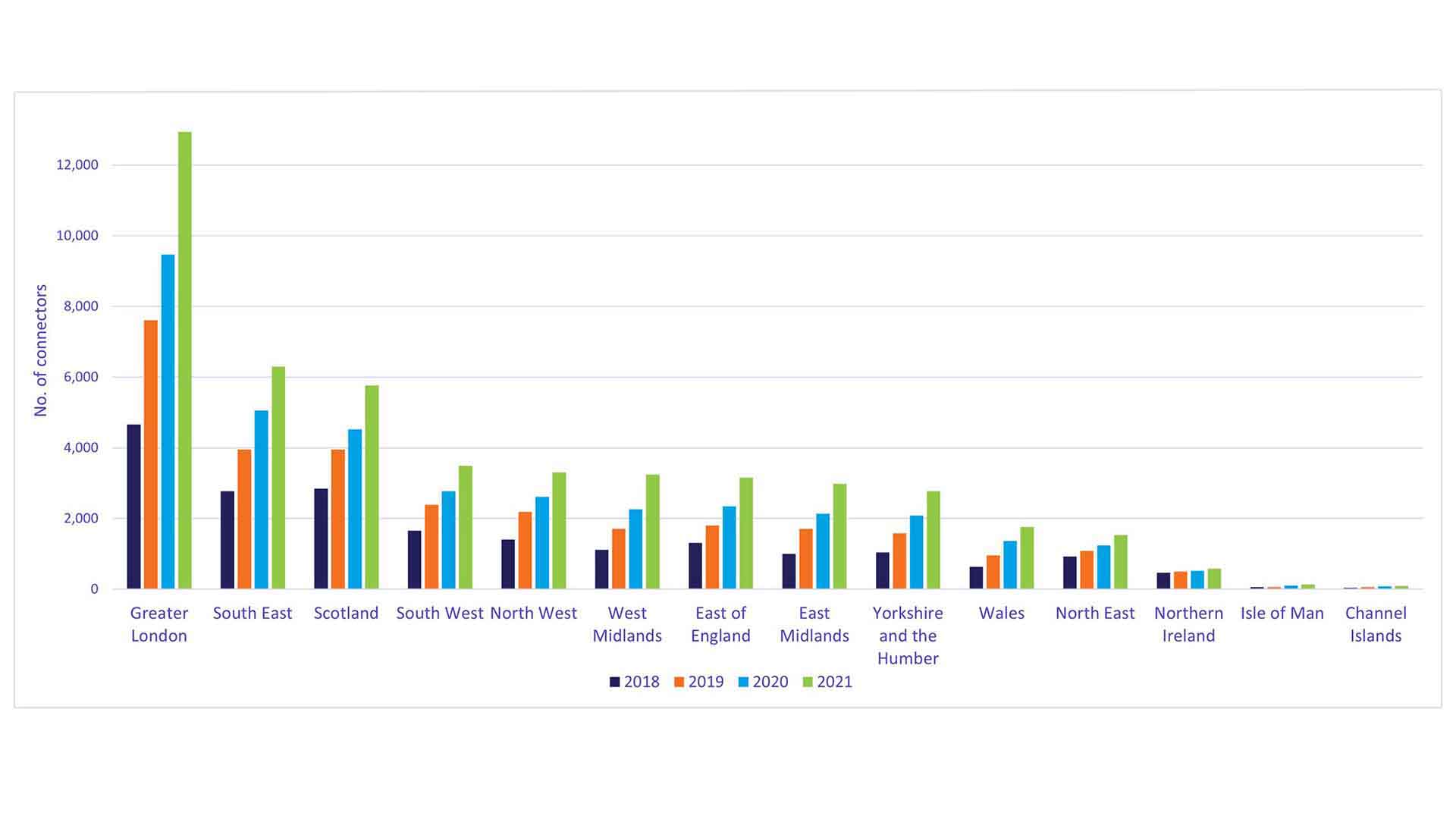

Although the number of charging points is increasing across the UK, there is a clear disparity in their location. Of the 48,056 EV charging connectors in the UK, over one quarter (27%) are located in Greater London which remains relatively unchanged from 2020. This is likely to be causing slowed growth of EV registrations in other regions of the UK. In fact, a concern about the lack of charging points, or ‘range anxiety’, has been cited as one of the main reasons for consumer reluctance to purchase fully electric vehicles.

As part of its 10-point plan for a green industrial revolution, the UK government pledged to invest £1.3bn in charging infrastructure, with targets of 2,500 high-powered charge points by 2030, rising to 6,000 by 2035. Building on this plan, a new Electric Vehicle Infrastructure Strategy was launched on 25 March which confirmed that £1.6bn would be invested to support the development of charging infrastructure. The government plans to increase the number of public charging points to a minimum of 300,000 by 2030, which is equal to nearly five times the number of fuel pumps on the UK roads today.

In the private sector, BP has also announced a £1bn investment scheme to increase the number of bp pulse charging points. BP hopes to grow its network to 24,000 chargers by 2030, which would triple its current number of charging points.

Fig: UK charging connectors by region

Source: Zap-Map

The future of EVs

Despite significant increases in EV registrations during 2021, the vast majority of vehicles in the UK are powered by an ICE and fuelled by petrol or diesel, which produce harmful greenhouse gas (GHG) emissions. According to the UK Department for Business, Energy, and Industrial Strategy (BEIS) the transport sector is the greatest contributor, of any individual sector, to UK GHG emissions, with road transport representing 91% of these emissions.

With increasing pressure to limit global temperature increase to less than 1.5°C, the government has committed to net zero GHG emissions by 2050. As part of this commitment, on 14 July 2021 the government published the report: Decarbonising transport: a greener, better Britain, which sets out the policies and investments needed to achieve the transition to zero emission cars and vans. This includes a ban on the sale of new petrol and diesel vehicles by 2030 and on the sale of new hybrid vehicles by 2035.

Along with the expansion of electric charging points this is likely to cause the continued accelerated growth of EV registration in the UK and will subsequently impact future fuel sales. However, EVs are not protected from the impacts of the current energy crisis. The EV manufacturing industry is facing challenges from rapidly rising energy costs and issues with global supply chains causing questions to be raised as to whether supply can meet demand for EVs in the UK, and how both soaring electricity and fuel prices will alter customers vehicle choices.

Thanks to Experian Catalist, which supplied most of the statistical data on UK service stations, and Zap-Map for allowing us to use their information on numbers and types of EV charging points.

EI Road Fuels Collection

The latest edition of the Retail Marketing Survey (RMS) is available as part of the Energy Institute’s Road Fuels Collection.

As part of this collection, you can find not only the UK fuel retail marketing statistics published since 1971, but also additional information covering the road fuels sector, from training courses to technical guidance.